This is the 3rd part of this series on Cash is reality. You can read the first blog here and the second one here.

In the first part, I started by mentioning why the Cash Flow statement deserves your attention. Here was Reason 1: Sales is vanity, Profit is sanity but cash is reality. In the second blog, I gave two examples- one where the PnL showed losses but in reality it was a wonderful business with a lot of cash flows. The second example was of a business that made a lot of profits on paper but was losing cash hand over fist.

In this blog, I will provide other reasons why the CFS deserves your attention.

Yes- and this is the series finale!

—

Reason 2: The PnL can be flawed

Example 3

There is a listed business that has a lot of resorts all over India. It sells 25-year memberships to its resorts and the members need to pay the 25-year membership up front. (Does up front, ring a bell from part 1?)

The Accounting standards say that since the membership is for 25 years, the company can recognize only 1/25th of the revenue each year. But all costs incurred in getting members are recognized in the same year. So in a way, the business shows Accounting losses the more memberships that it gets. And vice-versa. If it does not sell any memberships in a year, there would be recognized revenue but there would be no costs and so it would make an Accounting profits.

So you see this paradox: the more members it gets, the more losses it incurs. And if it gets no members, it shows profits. But the reality (cash flow) is opposite: the more members it gets, the more the cash inflow and if it gets no new members, no cash inflow from sale of memberships. If the CEO of this business went to Warren Buffett for advice, Buffett would tell him: do what counts and not worry about how it will be counted.

The CFS on the other hand, records all the incoming cash without discrimination. And remember what I told you about the special businesses that get cash in before the expenses go out? This is a special business that no one is paying attention to.

The PnL says that the business made a cumulative 94 Crs in 5 years!

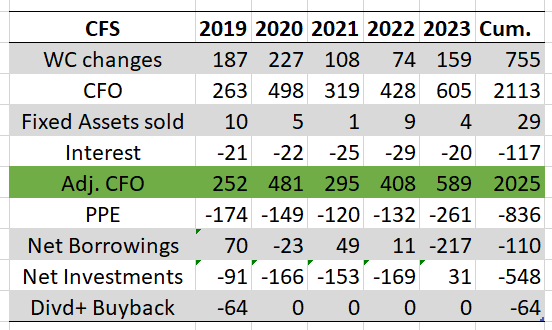

Now see what the CFS is saying for those same 5 years:

The CFS is saying:

- Because the customers pay the business up front, the more it grows it’s business, the more cash it gets. So over 5 years, it’s working capital has added an incremental Rs 750 Crs+ to the business.

- The business had large Adj. CFO of Rs 200 Cr+ in each year. The cumulative for 5 years is a whopping Rs 2000 Cr+.

- Rs 800 Cr+ has gone in to expansion (Property, Plant & Equipment)

- Rs 110 Cr has gone towards debt repayment

- The company still has surplus cash of nearly Rs 550 Crs that is parked in liquid instruments!

Compare 94 Crs of cumulative profits with Rs 2025 Crs of Adj. CFO. The P&L tells you it’s a cat; the CFS tells you it’s not just any cat.

Reason 3: Capital allocation

Capital allocation is about two things:

- from where did the capital (cash) come?

- to what did the capital (cash) go?

Essentially, there are 5 sources of capital:

- Issue Equity

- Borrow money

- Cash flow from core operations

- Float (getting paid up front)

- Sale of assets

and 5 uses of capital:

- Buyback to reduce equity

- Pay back debt

- Pay dividends

- Invest in growth like purchase of property, plant and equipment

- Acquire another company

To see how good a business is see if it can throw up more cash than it can consume.

To see how good a management is, see what they do with the cash.

And below is an example of the difference a management can make.

Example 4

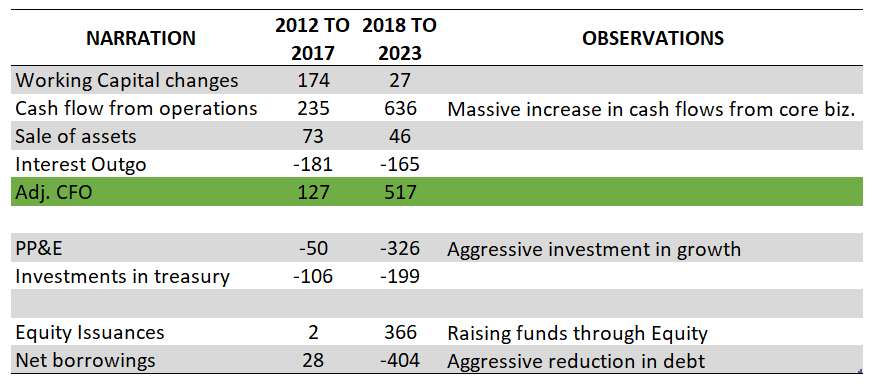

There is this export business and it had a change in management in 2017. Look at the table below. It has the Cash flow statements for the period 2012 to 2017 and 2018 to 2023. You will see the difference in approach of the two managements.

As you can see:

- The Previous management hardly made any investments in growth over 6 years. As a result of which the sales remained flat at Rs 1100 Crs from 2012 to 17. On the other hand, the new management invested 7X in growth (Rs 50 Crs vs Rs 326 Crs). In the past 6 years, despite Covid the sales has grown 2X!

- The new management raised capital via Equity and used it to pay down debt. As a result of that, the business is debt free as of now.

- However, the biggest change you can see is in the CFO (almost 3X) and the Adj. CFO (almost 4X)!

Like I said, what the management does with capital is what creates long term wealth for it’s shareholders. And below is the effect of that capital allocation strategy:

Reason 4: The CFS is simpler

As I have been saying, the CFS is extremely simple to understand. You can see how and where the cash is coming from and how and where the cash is going out. How much is coming in and how much is going out and what the management is doing with the surplus? Are they keeping a status quo like the Previous Management in Example 4 or being growth oriented as in the Current management?

So with a somewhat detailed analysis of the CFS you can see more of what is happening. I like that because I can verify if the management is doing what they are saying.

—

Conclusion

So, let me summarize all 3 blogs here:

- A business does not go bankrupt because it makes losses. It goes bankrupt when it runs out of money. A profitable business can go bankrupt if it runs out of cash (Example 2) while a loss making one may never go bankrupt if it does not run out of cash (Example 1).

- The Cash Flow statement is much simpler to understand. Just make sure you take a conservative approach of subtracting all non discretionary expenses.

- Future wealth creation depends on what the management does with it’s cash today. Therefore you can understand the Capital Allocation of a business by analyzing the Cash Flow Statement.

- The market will continue to pay attention to the PnL. It will make “adjustments” for this and that, but will almost ignore what is in plain sight. For example, I have heard analysts doing mental gymnastics to arrive at a term called “Cash Profit” using the PnL., when you can see the figure right there in the CFS. We can’t change this kind of behavior. But we can take advantage by paying more attention to the CFS. I have shared the how through Examples 1, 3 and 4.

- Cash is the reality.

In Feb 2017 I attended a session organized by the Tamilnadu Investors Association. The session was on “Cash Flow Statement” analysis by Prof. Raghu Iyer. Now, he is an expert on the subject and and even more so – a wonderful teacher. The room was full of investors and yet everybody learnt something new. And rightfully, everyone stood up for a standing ovation at the end.

I have only tried to take what I learnt that day and apply it to some real life examples.

—

Thanks for reading!

Cheers!

Excellent 3-part series Vikas. Amazon comes to mind as a classic example of people looking at PNL instead of CFS and reinvestment rate to miss out on a once in a lifetime business.

LikeLike

Fantastic observation Vishal! In fact, in many letters to shareholders, Bezos kept telling them to look at the CFS.

LikeLike