This is the 2nd blog in the Cash is reality series. You can read the first blog here.

A quick recap on part 1:

- Almost all investors are focused on the PnL while the Cash Flow Statement (CFS) is neglected. We can build our edge by paying more attention to the CFS.

- Profit and Loss are accounting concepts that get impacted by Accounting Standards.

- Cash on the other hand is a reality because cash is what is needed to pay suppliers, pay employees, pay rent, pay taxes, repay bankers etc.

- Therefore, the CFS is a far better representation of reality than the PnL.

—

In this 2nd blog, I plan to give some examples to show the kind of insights you can extract from the CFS. Before that, in very simple words I wanted to explain the structure of any Cash Flow statement.

The Cash Flow statement has 3 parts to it:

- Cash Flow from Operations (CFO): This is what tells you how much cash the core operating business brings in or how much it is guzzling.

- Cash Flow from Investing (CFI): This is what tells you how much is going into investments or how much is coming out investments. Investments could be of all nature- investments into Property, Plant and Equipment, investments into say Mutual Funds and acquisitions of other companies.

- Cash Flow from Financing (CFF): A business can raise funds through either borrowings or by selling stake (equity). A business with surplus cash can also pay back borrowings and do a buyback to reduce equity. If it has borrowings it would need to pay interest, which is also recorded here. If it pays shareholders dividends, that would also be recorded here.

To understand this better, imagine you are a parent and you will want your children to become responsible adults who can take care of themselves financially, which is like them having a big, positive CFO. If they have a big positive CFO, then they can invest in themselves too (CFI) – like higher education, courses, books etc. which can lead to even higher CFO in the future. On the other hand if they have a negative CFO, then they will most likely keep coming back to you for financing (CFF) which is unsustainable in the long run.

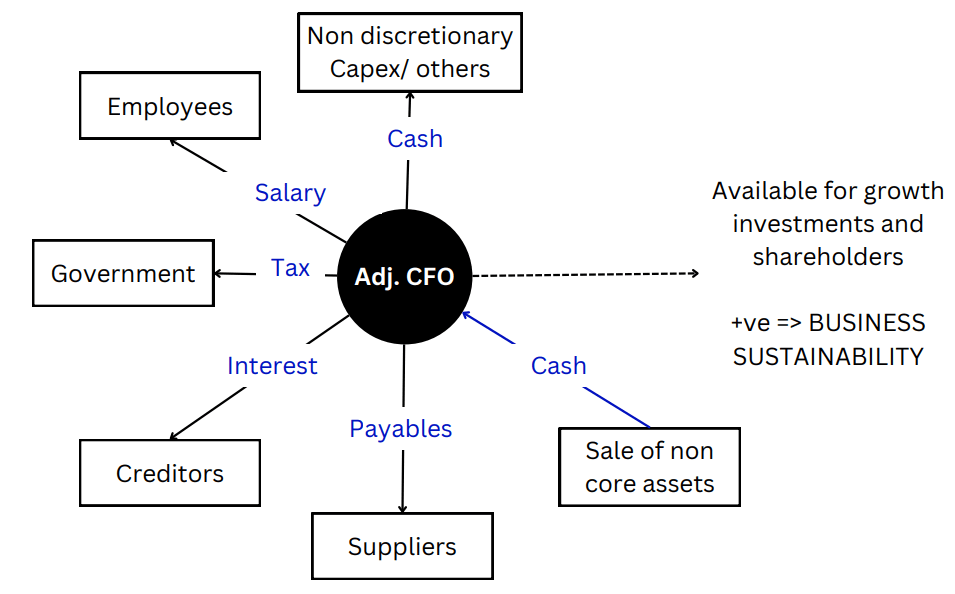

Similarly, as an investor, I want businesses that already have a solid CFO. Because that tells me that the core business is sustaining itself. But to be even more conservative, I compute a term that I call Adjusted CFO (you can’t say I am not creative). To get that:

- I start with the CFO

- I subtract Interest Payments (which is in CFF). Because not paying your Interest is not a choice.

- I subtract Lease payments (also in CFF). Because the landlord is also a key stakeholder that needs to be paid

- I subtract any other non discretionary expenses (which is basically a judgement call and will be found in the CFI). Non Discretionary expense for a telecom business could be when competitors are applying for 5G license and therefore you are forced to do so too. For a retail business, if competitors are installing A/Cs, then you are forced to do so too.

- I add any non core asset sales to CFO. (which is in CFI). This could be like selling your second car, (not the first) to put the money to more productive uses.

So why is the Adj CFO important? And why do I want it to be a big positive number? Because:

- It tells me that the business has paid all it’s stakeholders (Employees, Suppliers, Government, Lessors, Creditors etc.) and still has a lot of cash left. And since it has paid all it’s dues, it is sustainable.

- To understand the importance of sustainability, imagine you are an airline.

- If you don’t pay your pilots, your planes don’t take off.

- If you don’t pay your oil suppliers, your planes don’t take off.

- If your planes are on lease and you don’t pay your lessors, they will seize the planes and you won’t take off.

- If you don’t pay your taxes, then there will be a lot of complications including jail, raid and what not.

- If you don’t pay your bankers, the bankers can seize the planes and your company and then you will be forced to take off to safe havens.

- So you see, I want all stakeholders to be paid and be happy because then I have a sustainable business on hand.

- You may ask: “Just because the Adjusted CFO is positive, how do we know all stakeholders are paid?“. I don’t know for sure. But I do know if the Adj. CFO is negative then somebody is not paid and that is a risk.

- To understand the importance of sustainability, imagine you are an airline.

- I also want a lot of cash left on the table after paying all stakeholders and this cash can then be used for investing in growth or returning to shareholders in the form of dividends or buyback.

- A lot of cash is also like a margin of safety, just in case I forgot to pay somebody important.

Sorry- I needed to explain this concept of Adjusted CFO before I give you share some mind-blowing examples.

—

Example 1:

Note: When looking at the PnL and CFS, I like to take an aggregated view of at least 5 years. That way I get to see the bigger picture of what is going on in the company. To be even more conservative, you can take a longer time view too.

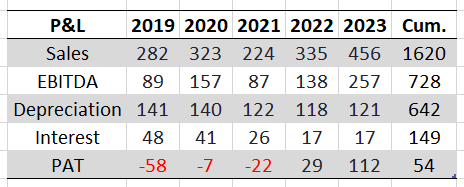

So…there is this actual company that leases out equipment. If you looked at the PnL, you may say:

- This business looks unstable. It made losses in 2019, 2020 and 2021 and them seems to have somewhat turned around in 2022 and 2023.

- They had a cumulative sales of 1620 Crs but a cumulative profits of only Rs 54 Crs or just 3.3% net profit margin.

- Business looks ordinary.

Now, take a look at the CFS. You will notice:

- This business has a big, positive Adjusted CFO in every year. That means the core business was sustainable every year, even during the loss making years and even during Covid times. That is extraordinary.

- They used the Adj. CFO (of 757 Crs) to pay down debt aggressively (Rs 369 Crs) as well as investing in future growth in 2022 and 2023 (Rs 309 Crs).

- Reduction in debt had led to reduction in interest payments, from Rs 49 Crs in 2019to Rs 18 Crs in 2023.

- They probably operate in a cyclical industry because they sold assets in 2019 to 2021, but have become aggressive buyers in 2022 and 2023.

So while the PnL gave you the impression that this was a somewhat lousy business the CFS seems to suggest that this is in fact a very good business because even during Covid they had big positive Adj. CFO and they have used the cash flows judiciously.

Remember that meme I had on how everyone listens to the PnL and almost no one pays attention to the CFS? Well imagine you had this kind of an insight on this business based on the CFS, this is how it would have worked out for you….almost nothing happened for 3 years and then 5X in 2 years!

It’s not that something magical happened in early 2021. The CFS would’ve told you some of these things even before that.

You may say “it’s easy to say this in hindisght“. No- I am saying in future, you can use this kind of analysis to identify what the PnL followers will miss (which is almost everyone).

Example 2:

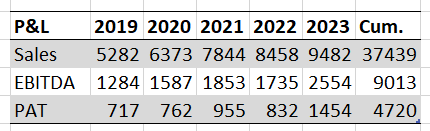

Now take a look at this company and tell me what you see:

You’d probably say:

- Wow!

- This a fast growing company. Sales have grown at 16% CAGR between 2019 and 2023. Wow!

- This is a profitable company too and in fact profits have grown faster than sales at 19% in the same time. Wow!

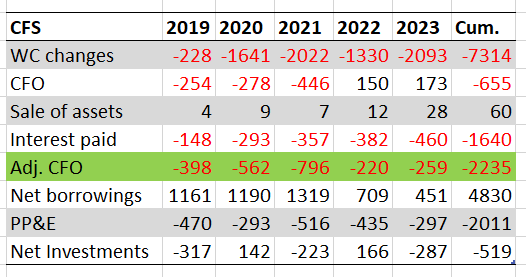

And now look at the CFS of this company and tell me what you see:

You’d probably say:

- OMG! The CFS is like a bloody battlefield!

- The working capital is where all the profits are getting stuck (WC changes).

- The Adj. CFO is negative in each year and at a 5 year cumulative of -2235 Crs.

- They have made aggressive investments in Property, Plant & Equipment (PP&E) too of about Rs 2011 Crs.

- So picture this: not only is your core operating business is losing Rs 2200 Crs+ but also you are making aggressive investments of another Rs 2000 Crs+ into the business. And therefore you need to make an incremental borrowings of Rs 4800 Crs+ just to foot all these bills!

- That large negative Adj. CFO tells me somebody in this ecosystem (could be suppliers, or landlords or employees or government) is neither getting paid sufficiently nor on time. Something may give soon.

The PnL looks like the nice and clean, Tom. But the CFS tells you that it is Tom in rags.

What if, tomorrow the lenders of this business stop lending? This has been known to happen in 2001, 2008, 2013, 2018 and 2020. What would happen to this business? And to it’s shareholders? This is a business that is unsustainable and living on the kindness of others!

Now, where in the PnL would you have learned of this?

—

So let me summarize this blog by saying:

- Everybody is focused on the on the PnL while the information is far richer in the CFS.

- When the PnL tells me one thing and the CFS tells me another, I always go with the CFS because Cash is reality. (That is just another way of saying I always go with the CFS 🙂 )

- A business goes bankrupt when it runs out of money.

- A profitable business can go bankrupt if it runs out of money (Example 2) while a loss making business may never go bankrupt if it never runs out of money (Example 1).

—

Thank you for reading. In my next blog, I plan to show how the CFS can be used to share insights about the capital allocation.

Dear Vikas,

Very nicely written blog. I have seen this happening. The order book is good but execution cannot be done because there is no cash to purchase raw materials. Finally the company ends up accumulating more and more troubles.

I wish you were given a chance to present it in your FLAME university program. May be you would bet another platform to promote this line of thinking.

Regards

Pramod Samvatsar

LikeLike

Thanks Bhai.

LikeLike

Thank you for the insightful article, Vikas!

A naive question: In example 1, why is the CFO (without WC changes) significantly and consistently higher than EBITDA from 2019 o 2021?

LikeLike

I asked too soon, the next post explains this with an example. Thanks!

LikeLike

Thank you for reading and commenting Arpan.

LikeLike