What is an Index? An Index is a collection of companies. The Sensex 30 is a weighted average of the 30 largest companies (by market capitalization) in the BSE . The Nifty 50 is a weighted average of the 50 largest companies in the NSE. Likewise there are other indices like Small Cap Index, Bank Nifty, Nifty Pharma, Nifty IT etc. etc.

What is an Index Fund? An Index fund mirrors the Index, say the Sensex 30 or the Nifty 50. So an Index Fund that mirrors the Nifty 50 buys all the 50 companies in the Nifty 50 in the same proportion. Therefore it’s returns would be identical to the returns of the Nifty 50.

So…what makes the Index Fund so special?

#1: Low cost

Now- since the Index is managed by the Stock Exchanges, you don’t need a fund manager or a research team or a mutual fund advisor to identify companies to invest in and hence there are cost savings that accrue to you. And hence as an investor you pay less in fees by investing in an index fund.

For example: Navi’s Index Fund claims to have an expense ratio of 0.06%. That is, if you invest Rs 100 through Navi- Rs 99.94 gets invested into the Index fund. Contrast that with another fund (non Index) that has an expense ratio of 1.5%. In that case, of the Rs 100 only Rs 98.5 gets invested.

# 2: Collection of blue chip companies

Like I said- the Index is a weighted average of the biggest companies in India. They have grown this big through several competitive advantages. And these are diverse companies from across the economy and hence you de-risk yourself through diversification. If a company does poorly, another is likely to do well and therefore you are protected.

# 3: Automatic rebalancing

The Index is rebalanced every 6 months, on the last day of March and September. So for example, on 30-Sep-2022 Shree Cements was removed from the Index as it’s market cap had fallen and replaced by Adani Enterprises. These rebalances are rule based. So- as an index investor, you have the advantage that by owning the Index- you will have the 50 biggest companies at any time in your portfolio.

All that is okay, what about the returns?

I have taken two examples just to illustrate the point and in no way are recommendations. In fact, my guess is that there wouldn’t be much difference in returns of Index Funds,, irrespective of which fund house (ICICI Pru, HDFC Mutual Fund, UTI etc) they come from.

The HDFC Index S&P BSE Sensex Direct Plan Growth has returned 12.6% since Inception. (Source: Groww). This is a fund that mirrors the BSE Sensex 30.

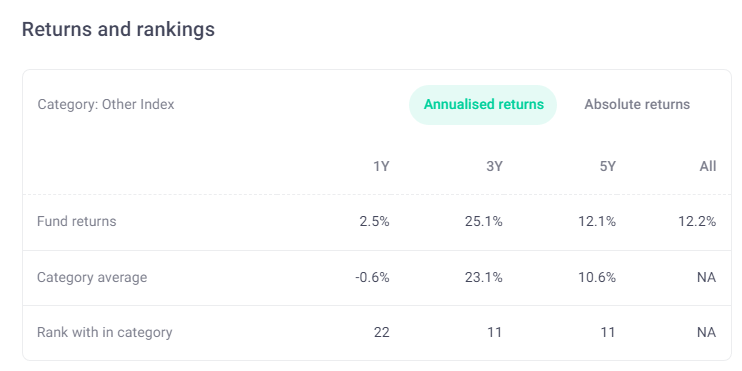

On the other hand the Bandhan Nifty 50 Index Fund Direct Growth Plan has returned 12.2% CAGR since inception. (Source: Groww). This is a fund that mirrors the NSE Nifty 50.The returns are similar to the one above.

You may ask: “These are past looking. What about the future returns?”.

No one knows what the future holds but I believe that in years to come, as India’s GDP grows, these funds will continue to provide similar returns to investors for the next decade or two at least. India is investing in infrastructure, cutting red tape, attracting Foreign Investments and has a huge population which is very young. I don’t know how experts can predict to the second decimal what the the growth rate would be, but I just take it as there will be a GDP growth of say 6 to 8%. So by owning an Index fund, you are owing a share of some of India’s best businesses through a low cost means.

—

So what does 12% even mean?

Let’s apply the Rule of 72. If you invest Rs 1 Lakh today, at 12% CAGR returns, you can expect to double your money every 6 years. That is 6 years later, it would amount to Rs 2 Lakhs, 12 years later it would amount to Rs 4 Lakhs, 18 years later it would amount to Rs 8 Lakhs and so on.

Now, suppose instead of investing Rs 1 Lakh only once, you invest Rs 1 Lakh as a Systematic Investment Plan every month for 20 years at 12% what would it amount to? Ans: It would amount to a staggering Rs 10 Crs!

That fantastic outcome is a result of the discipline of putting Compound Interest to work, month after month after month. It doesn’t require you to do big or risky deals. It doesn’t require you to even read the Business Papers or read annual report or attend conference calls. Nothing. It just requires you to setup an automatic transaction between your bank and your mutual fund.

In my previous blog, I had mentioned about that investment product whose returns were just 6.38%. Here, you have a low cost and a low risk option that gives you a much better return. Why would you not opt for the Index fund over the 6.38% one? You don’t have to be extra smart to figure out what the inflation would be, what India’s GDF per IMF or Moody’s would be, what the Dollar- Rupee rate would be, what China would do, what the Fed or the RBI would do, what the price of Oil would be etc.

As Charlie Munger would say- avoid stupidity rather than trying to be smart. Avoiding a product that offers 6.38% is avoiding stupidity. Investing via the Index Fund is being humble and saying I don’t have all the answers (like the ones above) but if some of India’s largest businesses do well, I’ll do well.

—

Conclusion

The Index Fund does not have a fund manager. Therefore, the non existent fund manager does not come on TV, does not do interviews, does not write articles in newspapers and magazines and does not visit B-schools to give talks. Because you have never heard his views, it’s likely you’ve never heard of the Index Fund either. Most fund houses that offer the Index Fund would try and switch you to one of their more esoteric products where they do have Fund Managers and research teams and where your money can help support them. So, my guess is, for most fund houses the Index Fund remains their best kept secret although it could be among their better performing products.

And therefore I am throwing the spotlight on this humble product.

The Index Fund should become a minimum a threshold in your overall portfolio. Therefore, you should ask before you invest – would I be better off investing in an Index Fund or through this other opportunity?

Sure- it does have risks like any other equity related product. But it is far safer (because of diversification and automatic rebalancing) and far cheaper.

My 22-yr nephew asked me how he should invest. And I recommended him to invest in an Index Fund via a SIP. It’s simple and powerful. Therefore, what I am recommending to my near and dear ones is what I am recommending to you as well. I have no vested interests in any mutual funds. And therefore I can say things the way I see them.

-Hope you found this useful and thank you for reading!

Some thoughts –

1. While selecting the index fund, the investor should minutely look at “tracking error” of the fund and compare it with peer group. In general, as size of the index fund increases, costs keep coming down and “tracking error” with the peer group and the benchmark reduces.

2. Index ETF’s are also a good option for people looking for buy & hold. The holding cost can be lower than a similar index fund.

3. Lastly, though index funds are excellent options for new & matured investors, they’re not free from limitations. For example –

a) A six monthly rebalancing would automatically put in “momentum” stocks into the index and take out stocks which would’ve had a bad couple of quarters. In your example above, I’d rather own Shree Cement than Adani Enterprises.

b) Index investing leads to “blind” investing by the institutions. The fund doesn’t care about the stock’s PE, the cash flows, the management, just it’s free float market cap. In a way, more passive flows into the same set of 50 stocks can lead to their price rising, which in turn would improve their comparative performance, which in turn would attract more money thereby creating a virtuous / vicious cycle. As Michael Burry had pointed out, passive funds could turn out to be the next bubble.

LikeLike

Thank you Vishal for highlighting these finer points.

LikeLike