Just the other day a friend of mine received a financial product recommendation from her wealth manager. The product that he recommended seemed too good. Imagine…you invest some money for some time and then you receive some annuities and finally at the end of the period you get all of it back! And during that time, you get insurance coverage too without any extra premium! That is…Insurance bhi, Investment bhi!

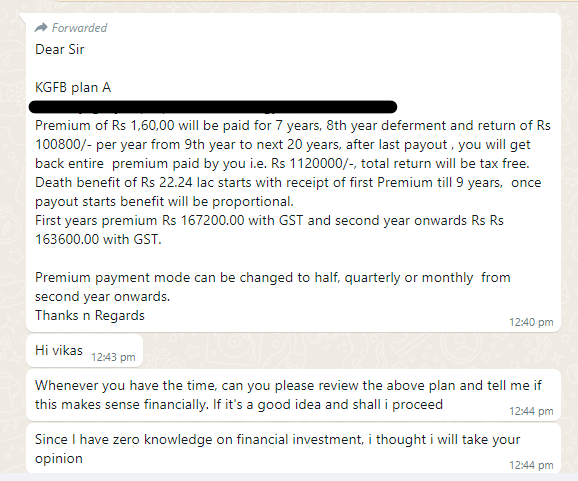

Now, here is how the product was structured:

- Pay a premium of Rs 1,16,000 per year for the first 7 years

- Do nothing for the 8th year

- The product will repay a pension of Rs 1,00,800 for years 9 to 28

- At the end of year 28, you will get back all the premia that you paid in the first 7 years. That is Rs 11,20,000.

- Not just that, there is a life cover of Rs 22,24,000 for the first 9 years and this reduces proportionately as the pay out starts.

I am sure we have either been approached by a wealth manager selling a similar product or like me you already have one that is firing on double engines of Investment and Insurance.

So what’s the catch here? To answer that, let’s analyze the two parts separately- Investment and Insurance.

—

Is this a good investment product?

Let’s calculate the product’s actual rate of return using a spreadsheet (see here) and XIRR formula. The XIRR formula tells you the rate of return when money goes in and comes out multiple times. Like here…money goes into the product for the first 7 years and comes out for the next 20 years.

The Rate of Return comes out to….hold your breath….6.38% per annum! That’s it.

Now, 6.38% barely beats inflation. And so I would say it’s not a great investment product!

Is it a good insurance product, at least?

The best insurance product tends to be the humble Term Life Insurance. In a Term Insurance you pay a small premium every year for say 30 years. If you pass away, your nominee gets a large lumpsum. If you survive, you don’t get any returns.

Unfortunately, most people think of the Insurance as a forced investment. Just as we are forced to pay car insurance. But really, insurance is to protect you in the worst case scenario. If you pass away, your Insurance will take care of your loved ones. If you get into a car accident, your insurance will protect you against a big bill for all the damages. No one plans on dying or getting into a car accident, but we do find ourselves in these situations once in a while :).

So…Insurance is for the worst case; Investment is to beat inflation. Mixing the two ends up being neither Insurance nor investment.

I have made this exact same mistake. I have two Life Insurance policies and I pay an identical premia every year. The first is that Insurance-bhi-Investment-bhi kind and the second is the Term Life. You can see the stark difference:

| Policy 1 | Policy 2 | |

| Premium per annum | Rs 15,000 | Rs 15,000 |

| Number of years | 20 | 30 |

| Life Insurance | Rs 3,00,000 | Rs 1,00,00,000 |

| Money back | Rs 3,00,000 | Rs 0 |

| Rate of return | 0% |

As you can see, Policy 1 is not only an inferior Insurance product but also a terrible investment product.

—

Now, suppose my friend would invest the same money (see here) in a low cost Index fund. The same 7 installments would lead to Rs 1.1 Cr at 10% p.a. and Rs 1.7 Crs at 12% p.a. by 2050. This is many, many times better than the Investment returns what the product is offering. Likewise, my friend can buy a 20 or a 30-year term life policy which would give very good coverage.

And this way, she can create a truly Investment bhi Insurance bhi product for herself.

—

To summarize:

- You should know that your wealth managers are incentivized to sell you these products. They need to sell these products to earn their salaries and promotions etc. Your bank also loves these products because selling them is highly profitable.

- You would be better off not mixing insurance with investment. Insurance is for protection and Investment is for beating inflation. For insurance opt for a simple Term Life plan. For investment, opt for a low cost index fund.

—

All these years, I have refrained from blogging about Personal Finance because I am not qualified to do so. But I have been coming across so many cases of wealth managers selling terrible products in the name of “Money Back” or “Guaranteed Returns”. Hence I couldn’t hold myself back from sharing how terrible these products are for you and me.

-Cheers!

Disclaimer: I am not a Personal Finance planner. So don’t take my word blindly. Instead, please educate yourself on things like Compound Interest, XIRR, Net Present Value, Index Funds etc. And see for yourself if products sold to you are really as good as they claim to be.

Dear Vikas,

Your exercise hits the bulls eye, and definitely it hurts (the person who is trying to sell such product).

Recently, at the last week of March, the end of year rush, my relationship manager wanted me to make some investments. I told her that I am a retired person, and I don’t have liquidity. Further, I am going to put money in SCSS after 1st April. Further, my account was open to her to see.

The RM wanted me to break some FDs (premature closure) and make some linked FDs and then after 1st April use that money to make my SCSS deposits. When I asked her to do back of the envelope calculations, I could show her that it makes no sense.

Finally I had to tell her that as a lay person I am supposed to think that my RM will be doing things in my interest and I am supposed to blindly follow her advice. And that I was disturbed with her approach which would mean financial harm to me.

So, finally the doctrine of Caveat Emptor applies.

Regards

Pramod Samvatsar

LikeLike

Thanks Bhai!

LikeLike

We’ve been making these XIRR sheets and showing comparative returns to clients for better part of 20 years now. Saved many from the “insurance bhi investment bhi” trap but couldn’t save all. The problem is compounding is counter intuitive. Sales people highlight what you’re going to get and people don’t realize time value of their money. The recent IRDAI changes which remove the caps on sales commission on insurance products will again vitiate the atmosphere for gullible investors.

LikeLike

Thanks Vishal. You have made an excellent point. Most people fall for the money back or the extra benefits that you get for free.

LikeLike

Hi there. This is Donald Gonsalves from SimplePath.in. Investing through insurance is one way of diversifying your investment portfolio. Here are my thoughts about investing in the above insurance plan –

1. The main benefit that insurance has, which no other investment option is able to offer, is tax-free yearly payouts and maturity. Although in the recent budget this benefit has been limited to premium payment of Rs. 5 Lakhs for new policies, a person has the option to save tax on interest/profits. 10% IRR on low cost Index fund could come with 30% tax deduction, leaving 7% in your hand.

2. Guaranteed Payout and Maturity – Just like bank FDs, both the payout and maturity amounts are fixed at the beginning when one buys the policy. That leaves no room for risk.

3. Policy continuance benefit – On an event of death of the investor, during the premium payment term, future payment of premium is waived off and the nominee receives all the payouts & maturity despite the death of the investor. No other investment option gives this benefit.

4. Most importantly, this investment comes with insurance. On demise of the investor at any point during the policy term, the nominee receives an insurance claim (tax-free).

This investment through insurance is especially for ensuring financial security for the spouse/family. A smart investor should check all options and benefits, not just IRR.

For more information, you can reach us on https://simplepath.in/book-a-call/

LikeLike

Sir,

Thank you for sharing your views.

Here are my simple thoughts:

1. Optimizing for tax. I think you are misinformed. Long Term Capital Gains tax is only 10% (and not 30%). So when you sell your index fund, you’ll pay 10% on the gains (and not 30%).

2. Conventional wisdom says we must optimize for tax outgo. But my 2 cents on that is we must not be penny wise and pound foolish. Buying a lousy product just to save tax is stupidity. In this case, the product as I explained, ends up neither providing a good return on investment nor an insurance.

The job of Insurance is to provide a big coverage to your beneficiary and not to provide a return on investment.

The job of an investment product is to provide good to great return on investment and not to provide coverage.

We must rather buy a product that meets our requirements.

LikeLike