(This is part 2 of my blog on network effects. For part 1, please click here.)

3. Pay attention to the liquidity on the platform.

Say, you want a cab. There are 2 services you can use, but the cabs are the same. What service would you use? I am guessing it would be the one that has the lower waiting time.

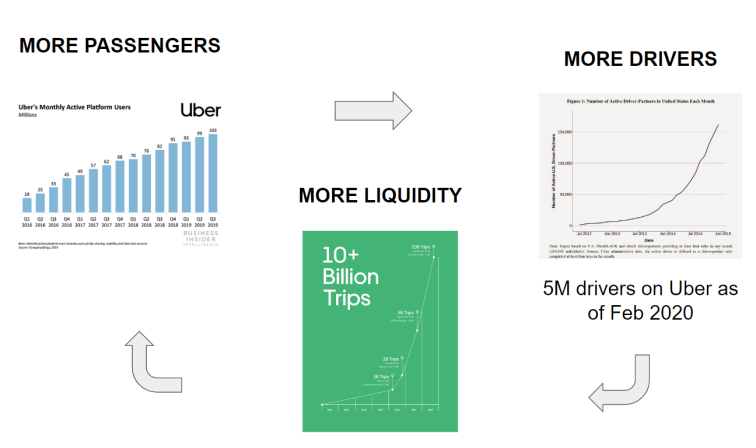

And how does a platform offer a lower waiting times for you? By having more drivers on any street at any given time. And if you asked drivers which platform would they drive for, they would say the same: the one with the lower waiting time. And how does the platform ensure that? By attracting more passengers to the platform (through incentives, availability, better service etc).

That availability when needed is liquidity. Platforms with more liquidity would gain more participants and thereby attract more liquidity. It’s like a virtuous cycle.

4. Online + network effects = winner take all

Think of the humble marketplace in your city. In Bengaluru, it is the KR market. It is where the traders come to sell their goods. It is also where the buyers come to buy goods. It reduces the search costs for both parties.

But as Bengaluru has grown, other smaller market places have come up in Electronic City, Yeshwantpur and other places where traders and buyers in that region can use. The price discovered for 1 Kg rice in the KR market may be a little different from the price discovered in each of the other markets. Such differences exist because the supply-demand scenarios would be different in each market.

Imagine if I had an online platform for all traders and buyers in Bengaluru. The sellers would soon realize that not only is it easier to sell online, but also through my platform they can sell to all of Bengaluru and not just a fraction of it. Therefore, more and more volumes are likely to come onto my platform which would bring in more buyers and so on. The price discovered on my platform would be uniform across all of Bengaluru. Traders and Buyers in KR market would peg their own rates to my rates.

Now, imagine that if you came up with a platform like Udaan, that had all rice traders and buyers across all of India. The price discovered on your platform would be even more efficient than mine and would be uniform across all of India. Gradually, we are likely to see the volumes on your platform become bigger and bigger. And it would be harder to dislodge your platform as an intermediary.

In other words, one winner (your platform) is likely to corner all the transactions and all the profits.

Once upon a time, like the local markets, you had local stock exchanges in Delhi, Chennai, Bengaluru etc. But with better network connectivity, the NSE has overtaken all of the smaller exchanges and they are now irrelevant.

5. In order to unseat an incumbent, your offering has to be 10 X better

Remember, I mentioned that it is hard but not impossible to beat an incumbent. It can be done, but for that your offering needs to be 10 X better. To beat an established player, you have to identify pain points that exist as of today and think of ways to make your own platform cheaper, faster, easier and better to use.

There are numerous examples where a late-mover overtook an established player such as Facebook overtaking the established MySpace in USA and Orkut in India. AirBnB wasn’t the first platform to offer bed and breakfast. Yet it’s website was easier to use and with lots of high quality images by the hosts that made their properties inviting. And it offered an insurance to hosts for property damage. These were some of the reasons that helped AirBnB to beat the exisiting platforms.

Finally, here is an example of how NSE, a startup beat an established BSE:

Exchanges are a glorified market place and tend to have network effects. The Bombay Stock Exchange (BSE) is today 140 years old and was Asia’s oldest exchange. Despite being the incumbent and having the lion’s share of the liquidity, it lost to the National Stock Exchange. (To know more, please read “Bulls, Bears and Other Beasts” by Santosh Nair.)

Back in the day, we had many stock exchanges across India. We had the Bombay Stock Exchange (BSE), Calcutta Stock Exchange, Delhi Stock Exchange etc. The BSE was by far the oldest and largest stock exchange. Trades on the BSE were routed through many brokers and sub-brokers. And each player charged his own commission and the commissions could be as high as 3 to 4%. Not only that, many brokers used to indulge in unscrupulous practices such as buying shares for themselves before executing the client’s orders and selling before selling on behalf of the client and thereby netting a profit on such trades. When a proposal was made to computerize the trades and instead of the open outcry system, it was blocked by the broker members. The BSE’s board was packed with broker members whose interests lay in the inefficiencies.

NSE, on the other hand started in the 90s with a clean slate. It computerized the trades and provided leased lines to its brokers. While memberships on the BSE was a closed club, the NSE welcomed new members. NSE was hungrier too, as it offered more trading days than the BSE. The introduction of electronic trading brought about more efficient price discovery and improved the liquidity on NSE dramatically. Cut to today: the NSE has a 93% market share in the equity and equity derivatives segment and the BSE only 7%.

Summary

This has been one really looooooooooong post. So I am going to summarize for you.

- Businesses that enjoy network effects tend to be super profitable

- In a 2-sided network, ask if it is one big homogeneous market or a market comprising of several heterogeneous niches

- In a 2-sided network, ask if it is one big homogeneous market or a market comprising of several heterogeneous niches

- Pay attention to the liquidity on the platform. Ideally it should go up over time.

- Online + network effects = winner take all

- In order to unseat an incumbent, your offering has to be 10 X better

- I dislike WhatsApp.

Thank you for reading.

Featured photo by Alina Grubnyak on Unsplash

I’m not that much of a online reader to be honest but your blogs really nice, keep it up!

I’ll go ahead and bookmark your site to come back in the future.

Many thanks

LikeLike