(Writing is hard. Its been over 2 months since I wrote a new blog, because I suffered from a bit of a block. So this blog has been extra hard for me to write. And therefore it may seem extra hard for you to read and for that I apologize.)

I am not a fan of WhatsApp. I hate it because it is addictive and makes me want to check it all the time. I have been trying to stop using WhatsApp for several years now, but unsuccessfully. For instance, I used to delete WhatsApp from my phone for weeks together. But, in India, everybody uses WhatsApp. Like for example, my nearby grocery store insists that I send orders on WhatsApp. My daughter gets birthday party invitations via my WhatsApp. My son’s cricket school communicates with parents only on WhatsApp. My apartment sends important instructions only on WhatsApp. So until my kids have gone to college and I don’t live in an apartment or need groceries, I am likely to have WhatsApp.

Why does this happen? Probably because WhatsApp is free to use, easy to use and convenient to share messages, contacts, locations, images and documents. “Just WhatsApp it to me” as they say. The group features allows many to many communication that SMSes can’t. As a result of all of the above, people use it to communicate and do business which forces others like me to use. And this is likely to encourage more people to further use WhatsApp thereby forcing more even people to use WhatsApp. This is network effects.

Much as I hate WhatsApp, I love businesses that enjoy the benefits of network effect. And this is what this blog and the next one is all about.

So why network effect?

Visa, MasterCard, Naukri, Google, Facebook, LinkedIn, NSE and others enjoy network effects. They are also big and profitable and are essentially toll bridges over which we must pay and proceed. But as a biased investor, I also think most of them are good for the society as they remove inefficiencies (like marketplaces) or help create value (like content creation on YouTube).

Warren Buffett spotted network effects in newspapers and in NetJets (a private jet sharing company) and owned these companies for a long time. Berkshire is also the largest shareholder of Apple (which enjoys network effects in iTunes).

In short, owning businesses such as the ones above are good for your fiscal health.

Some examples of businesses with network effects:

- Social media platforms like LinkedIn, Facebook, Twitter, WhatsApp, YouTube

- Classifieds businesses like Olx, Quikr, India Mart, Just Dial

- Exchanges like BSE, NSE, MCX, IEX

- Aggregator platforms like Ola, Uber, Google search

- Information networks like Visa, MasterCard, BSE Star MF

Some nuances of the network effects

I would like to share a few observations on network effects. Some of them weren’t obvious to me at first and so I have needed more time to understand and appreciate these nuances. Here they are:

1. Lookout for the market fragmentation

A 1-sided network is like WhatsApp or Facebook where everybody interacts with everybody else. A 2-sided network effect is like Uber where you have drivers on one side (suppliers) and passengers (consumers) on the other side. In a 2-sided network, a driver is unlikely to interact or transact with other drivers.

In a 2-sided network as more drivers join the platform, it creates more availability (called as liquidity) which in turn is likely to attract more passengers. So drivers are likely to join the platform that has more passengers, thereby creating more liquidity.

When the suppliers and consumers of any industry are consolidated, the role of a middleman in limited. But if the supplier base or the consumer base were to get fragmented you would have a middleman (human) playing an important role. But if the supplier and/or consumer base gets highly fragmented, then a technology platform is likely to outperform the human middleman as the aggregator.

Yahoo tried to manually aggregate all the web pages and present them while Google used algorithms to aggregate and present them. As more web pages got added, Yahoo lost and Google won.

In the Indian power sector there were a few generators (in 10s) and a few distribution companies (in 10s) until recently. As a result, the traders played a role in connecting the buyers with the sellers. But, in the last few years the government has allowed private companies to participate in generation and distribution. The government is also slowly and reluctantly allowing industries to buy directly from the generators themselves. Therefore, in a highly fragmented scenario, a technology powered exchange is likely to do a much more efficient job of connecting buyers and suppliers. As a result, over the years, the share of the exchanges is increasing and that of the traders is reducing.

Another anecdotal example. About 10 years ago, there used to be a taxi service company near my house. Every time I needed a taxi he would send me one in about an hour. This chap had a few contacts and together they had about 20-30 taxis on the streets. So depending on my location and my time, he would coordinate with his buddies and manage to send me one. But remember, the market was highly fragmented with millions of service providers (taxi drivers) and millions of consumers (passengers). And therefore, Ola and Uber with their technology can now do a much better job connecting passengers with taxis. So yet again, we see the technology displacing the human in a highly fragmented scenario.

So, look out for the level of fragmentation of the market.

2. One big homogeneous market preferable

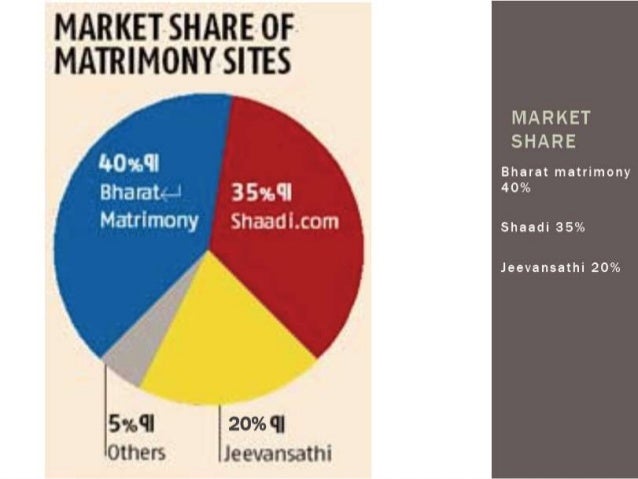

Think of the marriage market in India. It is highly, highly fragmented. There are different religions, sects, communities and so on. In effect it is a collection of many, many niches. As a result, Bharat Matrimony dominates some niches, Shaadi.com in some other and Jeevansaathi in some others.

Think of Ola. Say, they have conquered Mumbai with a market share of 70%. Does that in anyway give them an advantage in Delhi? No. So when launched in Delhi, it has to start it’s market share at 0 and build it up. And when launched in Chennai, ditto. Therefore, Ola or Uber will have to conquer each market separately and therefore it is going to be harder and more expensive to scale.

In both the above examples, you could see that there is no one big market. Rather it is a collection of many smaller markets. In a scenario like that it’s unlikely for one platform to dominate all the markets. Take a look at the Lyft vs Uber market shares in various cities and you will notice that Lyft dominates in some cities and Uber in others.

Contrast that with the Indian Energy Exchange. Here electricity gets traded. And each unit of power is the same as the other, irrespective of where it is produced or consumed. And therefore, these kind of platforms that deal with homogeneous commodities are likely to find it easier to scale.

This post has been continued in part 2.

Featured photo by Alina Grubnyak on Unsplash

4 thoughts on “Network effects – part 1”