There is this old joke. A home owner had a leaky pipe in house and called the plumber to fix it. The plumber came, took a while to inspect and after doing so he fixed the leak. “How much”, asked the owner. “$ 100” said the plumber. “$100?!! But the fix was so small and so simple”, said the owner. To which the plumber, said, “You are right. But $98 is for knowing what to do and what not to do. $2 is for the fixing”!

I never tire of telling this joke, even to friends that have heard it before. And I love the joke because there is a deeper meaning to it: that of finding a profession or business that pays you for more for your thinking than your actions. The cognitive part of thoughts, judgement etc. is invisible like the iceberg below the surface and the actions are like the iceberg above the surface.

There is an anecdotal version of this joke too. In the 1990s, Hatson Agro, an Indian dairy company, was thinking of introducing a new brand of sachet milk in Chennai which had a very strong incumbent. R.G. Chandramogan of Hatsun Agro, flew in marketing guru Al Ries from USA to Chennai for a consulting engagement and he paid a fortune for it. Apparently, Ries, sat through the sessions the whole day and at the end of it, he walked up to the drawing board and wrote 4.5% and circled it emphatically. And he said- price your milk higher than the competition and position it as having higher fat content than the competition.

Later, the employees of Hatsun asked their boss if he got his money’s worth for a circle with 4.5% in it! To which RGC said that anyone can draw a circle and write 4.5%. But, he was paying for the thought and not the action itself. So, Hatsun, did position their milk as a premium product and they successfully got market share against from the competition.

I find huge parallels of this joke and anecdote with my profession- value investing. Most people think that investing is buying low and selling high and pocketing the difference. That is like saying cricket is all about scoring one run more than your opponent. Or that Football is just about scoring one more goal. If it were only just that we wouldn’t pay to watch, would we? If investing was just about buying low and selling high, nobody would lose money in the stock market, would they?

No- what separates the great investors is the thought process. Most investors that I admire, work on improving their thought process, constantly reading and learning for years while the activity of buying and selling would comprise a fraction of the time. For example, Warren Buffett read the annual reports of IBM and Bank of America for over 50 years before buying them!

Let me give you another example of a friend who is also an investor. He is a voracious reader and a deep thinker and he has a full time job which is not in investing. In the last decade he has participated in only a dozen transactions. But each of his bets has been big.

For example, during demonetization, the price of Bajaj Finance crashed by about 20%. The market thought that without cash in the economy, there would be a lot defaults and therefore the NBFCs were going to suffer. The market was a little right, but mostly wrong. For about six months, things were difficult and several finance companies reported high NPAs. But things went back to a new normal as well. At the height of pessimism, my friend deployed a big part of his net worth in buying Bajaj Finance and held it for a year and made 100% gains on that. What gave him the insight to buy? Years of reading books and studying of lending companies in India.

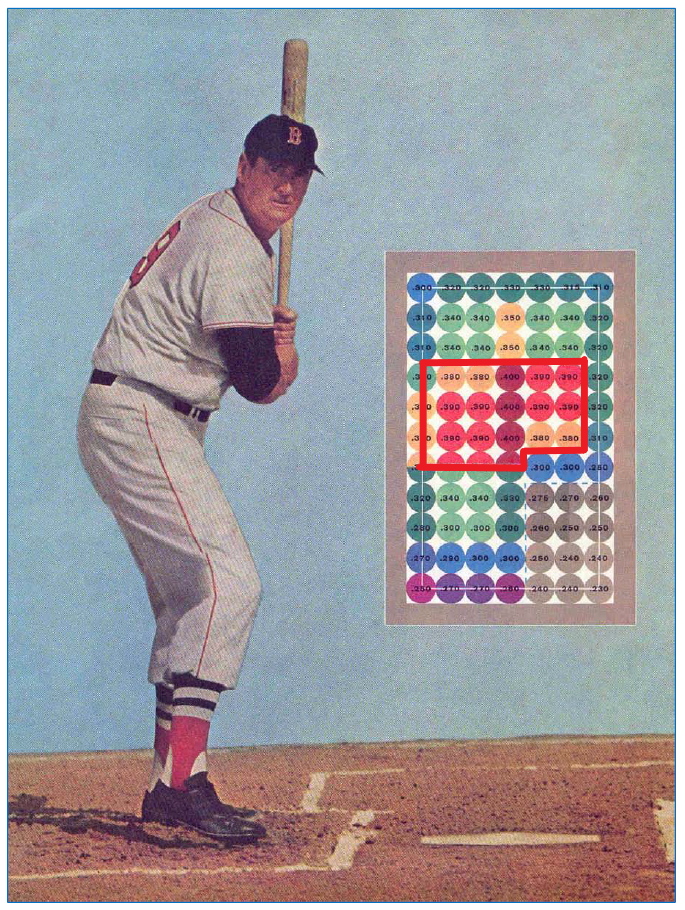

Ted Williams was an American Baseball player and he wrote a book called “The Science of Hitting”. In it, he says that he went after only those pitches that were likely to go for home runs. He says:

My first rule of hitting was to get a good ball to hit. I learned down to percentage points where those good balls were. The box [below] shows my particular preferences, from what I considered my “happy zone”—where I could hit .400 or better—to the low outside corner—where the most I could hope to bat was .230. Only when the situation demands it should a hitter go for the low-percentage pitch. Since some players are better high-ball hitters than low-ball hitters, or better outside than in; each batter should work out his own set of percentages.

Warren Buffett has quoted this idea from “The Science of Hitting” several times in his talks. He has said that in Investing, unlike Baseball, there are no called strikes. And so he can let any number of pitches go by and he goes after only pitches that are in happy zone. He could go for months or even years without buying or selling while reading, thinking and preparing for the eventual fat pitch.

Therefore, dear readers, prepare long and hard. But act only when the odds are heavily in your favor.

Cheers!

Featured photo: by Alexander Hafemann on Unsplash

I will quote the following as my response : Davy Greenberg With best wishes Raghu Sent from Yahoo Mail on Android

LikeLike