Dear R G Chandramogan sir,

I am in complete awe of what you have achieved over your lifetime! You may have heard of Warren Buffett. One of the things that he looks for in companies is that they buy commodities and sell brands. You sir- have done just that. You buy milk from farmers which is a commodity and then you process it and sell it in the form of brands — Arun, Ibaco, Oyalo, Arokya and Hatsun.

And the brilliance of your strategy clearly shows. Your sales has grown at about 17% compounded rate and profits at 18% compounded rate for the last 10 years! Even more commendable is that while your operations have become larger and more complex, you have treated the poor farmer fairly and made him a beneficiary of the process. I personally am touched, when I see capitalism with a human face.

I, on the other hand have not even run a lemonade stand and all my knowledge about business is through books and commentary. Therefore with all humility, I would like to tell you that you missed a trick.

You must be flabbergasted that I am saying this. Probably even angry and may accuse me of arrogance. But it is true sir; you overlooked one such powerful universal law and that is what I would like to point out to you. What is that? It is Compound Interest, sir.

Sir- I don’t know who said this, could be Einstein but I am not sure, “compound interest is the eight wonder of the world”. Most people think that compound interest begins and ends in high school. But no- it is very much alive in the real world and when you find a compounding machine, you better hop on for the ride.

In at least one interview you have said that today your one hour of sales is equal the sales of your first ten years and the sales of one day is equal to the sales of your first twenty years. This is another manifestation of compound interest.

Sir- coming back to that trick that you missed, without knowing anything at all about your business, I can assure you that with just one small change you could make even more money for your shareholders. Just one small change. Your business would remain exactly the same; you can continue doing everything in exactly the same way and nothing changes, except this one small thing.

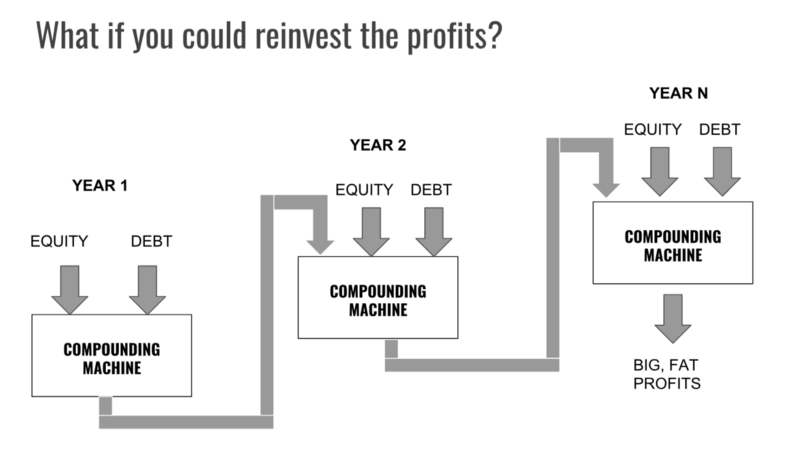

Let me explain. Sir- I am sure you think of your company as a dairy company or a logistics company or a milk processing company. But I think of your business and every other business metaphorically as a compounding machine. It takes input capital in the form of shareholder’s equity, external borrowings and profits from the previous year and throws out profits for the next year. Something like this:

So what is that one change I ask you? You sir, have been generous to a point of fault in paying out dividends. I ask that you pay no more than 10% of your profits as dividends and your outcome would be even better. By reinvesting your profits, you are compounding that additional capital also at 35–40%. Your shareholders would thank you in the long run for that.

Between 2013 and 2018 (both years inclusive), your company earned profits of Rs 451 Cr and you paid out Rs 223 Cr of dividends. That’s a dividend payout ratio of nearly 50%.

You retained the remaining 50% and borrowed an additional 677 Crs during this period for business expansion. And your company compounded capital at approximately 35 to 40% during those 5 years! Sir- those dividends that you paid out, have been a criminal waste of money! By retaining a higher proportion of your earnings (say 90%) you could have taken lesser debt and paid our lesser interest costs. More importantly, that money that you would have retained would also have compounded at the rate of 35–40%. Your shareholders would have been even more rewarded that way.

Not convinced yet? Let me prove it to you. Let’s assume a scenario 2, where you pay only 10% of the profits out and retain the remaining 90% in the business for expansion. Remember, I am changing only the dividend payout ratio; your core business remains just the same and my change has no bearing on the company’s sales or profits. Here is what the alternative reality may have looked like.

By paying out only 10%, you are retaining 90% for the company’s operations. Therefore you would need lesser debt than Scenario 1 and lesser debt would mean lesser interest expense. As you can see, in this scenario you would have saved Rs 243 Cr over 10 years, just by that one small change. Your debt on the books at the end of FY 2018 would have been 843 Cr instead of Rs 1008 Cr currently.

Knowing you, I am sure I could’ve convinced you of an even more drastic path- that of not paying any dividends at all and retaining all the profits. Here is what that would have looked like:

In Scenario 3, you can see that you would have a debt of only 790 Crs and a cumulative savings of 312 Crs!

As you can see sir, I made just one small change in your dividend payout policy and the outcome has been vastly different. Compound Interest is like that – one small change can produce vastly different outcomes.

If you have been convinced, hopefully you can convince your CFO, your board and your shareholders to go along with you.

Thank you for reading my open letter to you.

Your ardent fan,

Vikas Kasturi

2 thoughts on “An open letter to RGC”