According to http://www.dictionary.com, Russian Roulette is a deadly game in which a player loads a revolver with one bullet, spins the chambers and fires at his own head. If you survive, you get $1 Million and if you don’t survive, well…you don’t get anything.

Russian Roulette is a metaphor for gambling foolishly.

Say we play Russian Roulette not with a gun with 6 chambers but say with a gun with 1000 chambers. 999 of the chambers are empty and only 1 chamber has the bullet. So technically, there is a 99.9% chance of ending up with $ 1 Million and 0.1% chance of death. We have all options available to us. Play it once or play it as many times as you wish or simply walk away.

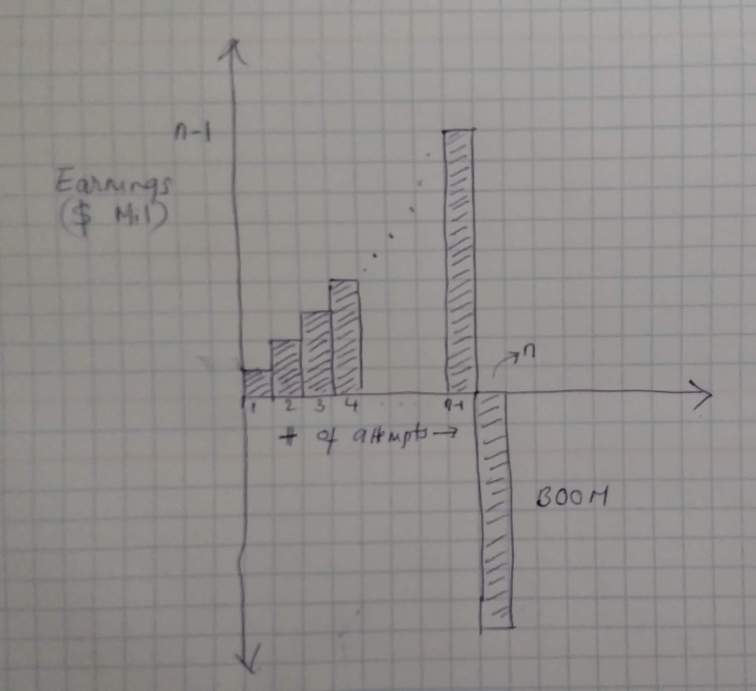

If you choose it play it many times, your outcome would look some thing like this:

You could have a very very looooooooooooooong winning streak, but the one unlucky event will wipe out all your gains! And here is another morbid thought: the longer you play, the more likely you are of encountering that unlucky event.

Wisdom lies in walking away and not playing the game ever.

—

Since my last blog, it has emerged the Credit Rating Agencies were actually taking bribes to give IL&FS a AAA rating. It was amply clear to the CRAs as early as 2012, that IL&FS was in a mess and yet they didn’t do what is right. Please refer to this article on Bloomberg Quint, dated 19 Jul 2019 which quotes:

Grant Thornton, in its report, said a review of communications between rating agencies and IL&FS group officials showed that although credit rating agencies had concerns as early as 2012, the ratings assigned to IL&FS firms remained high until middle of 2018.

The concerns, including around potential stress and liquidity indicators, were related to three IL&FS companies — IL&FS Transportation Networks Ltd., IL&FS Financial Services Ltd. and IL&FS Ltd. The ratings of these firms, however, were not downgraded.

Grant Thornton found instances of rating agency officials and analysts getting gifts and benefits such as smartwatches and football tickets from IL&FS companies and officials.

- Once such instance was where Bawa helped the wife of a senior rating official at India Ratings purchase a villa at a discount of Rs 43 lakh. Bawa also helped the couple defer interest charges on delayed payments by speaking to the head of a real estate firm. Multiple emails between September 2012 and August 2016 were cited by Grant Thornton.

- In April 2015, Saha provided D. Ravishankar, founder of Brickwork Ratings, tickets for a football match at Madrid in the IL&FS corporate box. The email exchange, Grant Thornton said, suggested potential favours were arranged for key rating agency officials.

- Communications between IL&FS officials also suggested that they helped purchase a Fitbit or smartwatch for the managing director of CARE Ratings.

- Grant Thornton’s review also threw up a Rs 25 lakh donation by IL&FS to the Sameeksha Trust, whose managing trustee was the chairman of ICRA.

Just like the Russian Roulette, every time the CRAs rated IL&FS with a AAA, they were showered with bribes such as villas, Real Madrid football tickets, smart watches etc. These were the lucky strikes. As they played more and more, they became numb to the possibility of the existence of the lethal bullet. And September 2018, when IL&FS defaulted, was that lethal bullet! You can read about it in my previous blog.

But sadly, the CRAs have no skin in the game. It’s like, they were playing Russian Roulette, but turns out they were just pointing the gun not at themselves but at the mutual funds, their investors and everybody who trusted the CRAs. Lucky strike, they win; unlucky strike they still win but everyone that trusted them loses.

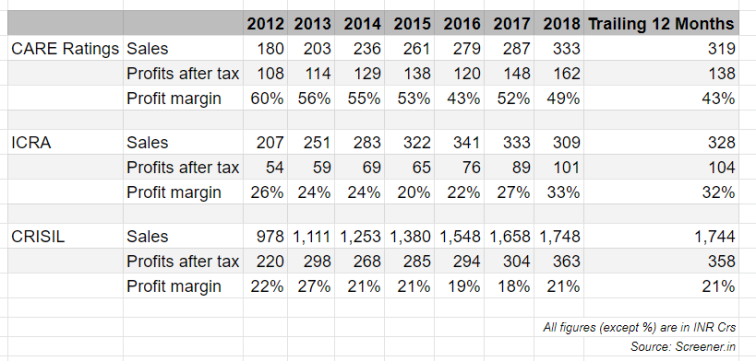

The CRAs will be ok. They will continue to make insane profits and laugh their way to the bank. They have no liability despite causing the mess.

If the report of bribe taking and receiving is true, I hope that SEBI and the courts would come down with heavy punishments on the CRAs. Kill one, scare a thousand!

—

So let’s ponder of the Russian Roulette games you and I playing, without realizing it? Sugar, bad driving, bad eating habits, tobacco, not exercising, excessive debt, cutting corners are some Russian Roulette examples. Every day that we didn’t get killed is just a lucky strike. But what happens if we are unlucky just once?

Think about it and you may act differently.

Cheers!

Featured image credit: Photo by Elijah O’Donnell on Unsplash

If this is happening behind the curtain, then this is horrible. Every AAA downgrade should be recover from CRAS

LikeLike

As per the report, it has been happening. As long as the model is such that the Bond Issuer has to pay for getting it rated, we will have this happening. Because the CRAs will be loyal to their paymasters (whose bread I eat, his song I sing) and will continue to take small and large liberties while rating.

LikeLike