Below is a fictionalized account of the current crisis written for entertainment purposes only. I have taken a few facts and dramatized them for effect. As such, I know very little and the below version may be incomplete and/or incorrect.

Scene 1:

It’s early 2018.

The managers at IL&FS are nervous.

They borrowed money for short duration at a lower interest rate and lent it at a higher interest on a long duration. The difference between the two interest rates is their income. But they need to pay back the short duration loan. And most often they would pay the minimum due and roll it over for another 3 months. After that another 3 months. And so on.

This model worked as long as they could keep servicing the short term loans. Nobody, bothered about the with the what-ifs, like:

- What if, the person they lent to defaults? How would they then re-pay their own lenders?

- What if, their lenders for some reason stopped lending? How would they meet their short term interest payments to say other lenders?

Looking back 2014, 2015 and 2016 looked like a walk in the park. India was credit starved and every where they looked, there were so many eager borrowers and eager lenders. The party didn’t look like it would stop ever, even if they wanted to.

Damn, if only they hadn’t gotten so careless with their lending and their own operations! Some of those borrowers stopped paying citing this and citing that. It started small, but now it’s full blown. Without incoming interest payments, they don’t have the money to pay the outgoing interest. They need to borrow more which will help them meet the current shortfall and help them buy some more time to find a fix.

Their only shot at survival is if they can borrow some more time to tide over this crisis. For that, they need the credit rating guys to look the other way for a few quarters maybe, until they fix this cash flow mismatch. It can be done, with some luck. But for now, their only hope is to buy more time.

Scene 2:

Early 2018.

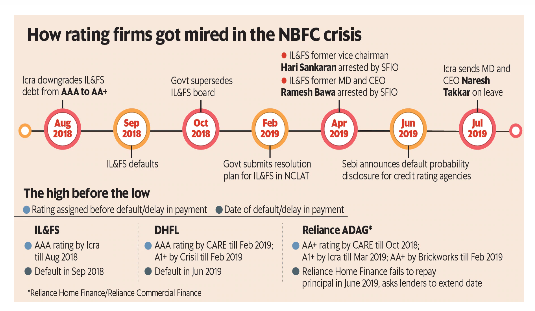

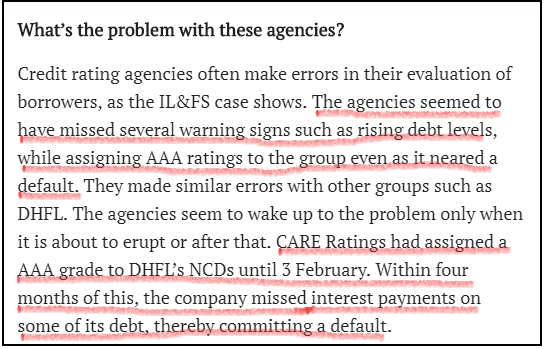

The credit rating guys are worried. They know they goofed up the previous time when they rated IL&FS a AAA. Surely IL&FS didn’t deserve a AAA. But what could they do? The fees was too good and if they didn’t rate them AAA, the other rating guys would. Their own shareholders would demand growth and profitability and if they began to take the moral high ground every time, what would they tell the shareholders? This is how the world works, they say. And anyway, these IL&FS guys will get their act together and things will look good again. And nobody would be any wiser.

But if they admit to their past mistake now, what would happen to their reputation? Their hope too rests on IL&FS fixing this. If that plan fails, they would just raise their hands and blame IL&FS for the whole thing. As a rating agency, their reputation would take a hit, but the damages could be contained.

So: the show must go on. The rating guys give IL&FS a AAA rating, so that they could continue borrowing and buy more time to fix the mismatch. But this would the last time, they warn.

Scene 3:

It’s September 2018.

6 months have passed since IL&FS got a AAA from the rating guys. Unfortunately their plan didn’t work out. The incoming cash flows stayed stubbornly small.

And they are out of lifelines. It’s all over! Like rats, the top management is abandoning the ship.

They are going to default on their interest payments soon.

Scene 4:

September 2018.

IL&FS’ default is all over the news. Investors in debt mutual funds having exposure to IL&FS get nervous. They want their money back and start to make redemption requests.

DSP Mutual Fund, sells 300 Cr worth of DHFL bomds to pay the redemption requests. DHFL shares tank and fear spreads that DHFL is going to default too.

The DHFL managers are worried too. How could this happen to them and that too for no fault of theirs? They approach the credit rating agency and ask for a rating. And the credit rating agency rates them with a AAA!

And the DHFL managers go to the market and tell everybody – “look guys, our shares went down as collateral damage caused by IL&FS. We are AAA rated by ICRA and CARE”.

Scene 5:

Rakesh Jhunjhunwala pied-pipers his way into DHFL followed by small investors. Surely, the big bull must know something.

I have a friend who is very frugal by nature. He decides to invest some of his savings in DHFL stock and even more so in the AAA rated non-convertible debenture of DHFL. He is probably influenced by the big bull.

Very soon, he and I are going to learn a very valuable lesson by Graham who said something to the effect that a bond isn’t necessarily safer than a stock; safety comes from the enterprise quality.

Scene 6:

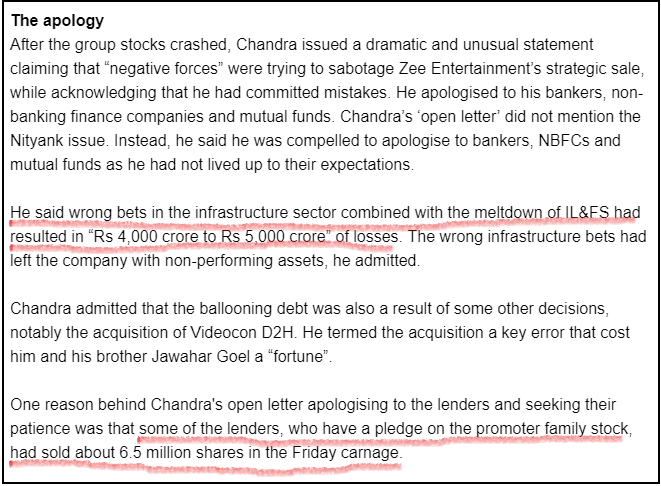

Elsewhere, Subhash Chandra has gotten itchy. He has a great business in Zee TV, that throws up a lot of cash every year. It’s predictable and monotonous. Surely, he needs to do something with it right? He is smarter than that other guy who started an airline and so he decides to get into infrastructure development that has “synergies” with the TV business. And so he decides to pledge a lot of his shares of Zee and takes a big loan against it.

And unexpectedly(?) the infra business doesn’t take off. All the borrowed money has gone puffffffff!

The banks that believed in the synergy story get nervous. Should they sell the pledged shares and recover some money? If they do sell, say 20% of the shares, the price of the shares would fall and even the remaining 80% that they hold would also lose value. It’s like – collectively if all the lenders believe that the shares of Zee are valuable and continue to hold them, the shares would continue to be valuable. Collectively, if they sell them thinking they are going to be less valuable, the shares would indeed become less valuable. Like self-fulfilling prophecy. And prisoner’s dilemma.

News of the Essel group’s failed infra projects and their pledged shares reaches all. There is nervousness among all. The banks worry that the NBFCs would default. The NBFCs worry that the builders would default. They builders worry that if they don’t get funding soon, they will default. The customers worry that prices of cars, bikes, homes etc. would fall and so they put off their purchases.

Because of the lack of funding, things turn worse for NBFCs in the home finance business. Like DHFL.

Scene 7:

It’s June 2019.

DHFL finds itself in the same fix as IL&FS was. The cash inflows aren’t enough to service the interest payments. Their own lenders have vanished and calls aren’t being returned. The few that actually answer the call, tell them politely that their mandate is to reduce their own exposure to home finance companies.

Out of options, DHFL defaults on it’s interest payments.

And then the stock comes crashing down. And so do the “AAA rated” bonds. They are rated junk now. AAA to junk in 4 months?

Scene 8:

My friend is broken. His investments in the stocks and bonds of DHFL have taken a massive beating. But he puts up a brave face and tells me- “They were AAA rated. Even mutual funds with their army of researchers lost their shirt. What chance did I have?”

The rating companies (Crisil, CARE, ICRA) make tons of money. They rate debt instruments for others, but they themselves are so insanely profitable that they don’t need any debt. They may have their responsibilities towards the lenders that trust the ratings, but they get paid by the borrowers. And therefore structurally, their interests lie with the borrower. Kind of like: “whose bread I eat, his song I sing.”

The benefits of the rating business is shared by a few but the costs of wrong ratings, dishonest ratings, mis-ratings, “genuine oversight” is borne by the society. This is an example of ‘privatized benefits, socialized costs’.

As we speak, the CEOs of ICRA and the CEO of CARE have been fired. I hope more heads would roll. And honestly, I think they should go to jail. For two reasons- one, they have to show some skin in the game. They can’t rate irresponsibly and not be held accountable. How can a debt instrument go from AAA to D in four months? They must’ve been wrong at either point of time. Two- there is a saying: “kill one, scare a thousand”. By making an example out of them, others would fall in line.

Now what? The lenders aren’t lending. Businesses that depend on a constant flow of credit, like builders, will find themselves in a very very difficult position. If enough lenders believe builders are risky and don’t lend to them, guess what, the builders will default and prove them right. If enough customers believe that house prices are set to fall and don’t buy, the house prices will fall because of a fire sale. What we don’t want is a credit crisis, this time made in India.

It’s too early to write the ending. Because, much more is likely to come. And only in hindsight, we would know who was entwined with whom, and who was making what mistakes.

Brace yourselves!

(Featured image Credit:Photo by Nik Shuliahin on Unsplash)

Extremely well presented. Enjoyed reading thoroughly.

LikeLike

Thanks Raghu uncle.

LikeLike

Thanks for writing this piece.

Informative. Entertaining. Blunt.

Love your one liners —

“Like rats, the top management is abandoning the ship.”

“What we don’t want is a credit crisis, this time made in India.”

LikeLike

Thanks for writing this piece.

Informative. Entertaining. Blunt.

Loved your one liners —

“Like rats, the top management is abandoning the ship.”

“What we don’t want is a credit crisis, this time made in India.”

LikeLike

Thanks Anshul.

LikeLike

Thanks Vikas, interesting read,crisp and clear

LikeLike

Thank you for the kind words.

LikeLike