This is Rahul Dravid’s career graph in Tests.

He finished with a career average of over 50 and among the all time top 10 test batsmen. Barring 2012, he never averaged below 31.

After every slump he bounced back. Like in 2008, he averaged just 31 and media was painting it as if it was the end of the road for him. He bounced back and doubled his average to 64 in 2009! Imagine, if Dravid was a stock, betting on him in 2008 would have fetched you 100% returns in 1 year!

—

Recently while talking to a friend, he said one of his mistakes was not backing up the truck and loading up on Infosys when everyone was pessimistic about it in Aug/Sep 2017. In short, he was saying that Infosys of 2017 was like Dravid of 2008. Everyone looked at the current scorecard and was writing them off without appreciating their ability to bounce back. Therefore, the point when everyone is writing off Dravid, is the exact time when we must be willing to do our own research and back Dravid because fantastic returns are usually preceded by times of maximum pessimism.

Which are those companies that can bounce? Let’s invert the question and instead ask- what companies are unlikely to bounce back?

- Companies whose Operating cash flows are likely to be negatively impacted. Operating cash flow is the bread and butter of the business and if that gets impacted a lot of other things get impacted like the ability to pay interest on debt ability to pay employees and vendors and things can very quickly spiral out of hand. Example- Jet Airways. Their inability to pay their lessors meant that the lessors took away their planes which meant fewer aircrafts and lesser future earnings potential. Cancelled flights meant fewer customers wanting to book flights which would lead to lesser future potential. Inability to pay employees would lead to fewer pilots showing up for work. So you see, when things go downhill, it has a knockoff effect on other parts of the business hastening the fall.

- Companies with huge borrowings. These companies would usually also have huge interest costs and inability to service the borrowings would have severe repercussions such as credit becoming very expensive or becoming unavailable. Example- Jet Airways, Kwality Dairy

- Companies whose customers start cancelling contracts and begin walking away which could lead to other customers following suit and which could then impact operating cash flows. Example- Welspun.

- Loss of faith in the company due to accounting frauds, corporate governance issues leading to severe de-rating. Example- Kwality Dairy

- Companies that depend on a key ingredient like airlines need fuel or leases to continue.

So, if none of the above has occurred, then doesn’t the perceived risk actually reduce? Yes it should.

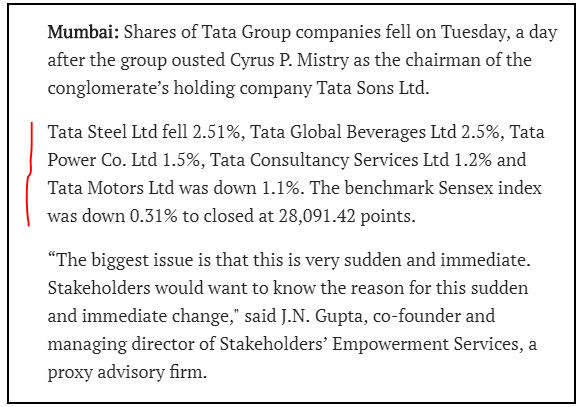

So let’s rewind and recall the times of August 2017, when Vishal Sikka resigned:

And like this when Cyrus Mistry resigned from the Tata Sons board:

If you notice, the media uses jargons of war to sensationalize the events like – “hits back”, “surgical strike”, “blow up”, “feud” etc. Creating a war like metaphor plays on our psyche like nothing else. To the media, such events are the equivalent of a juicy full toss delivery and they will go for the maximum. I am sure the senior journalists will brush aside their junior colleagues to write such juicy columns themselves.

No wonder then, Mr. Market who reads the newspapers and believes everything falls for it. Like this:

And like this:

And like this:

Now- what the media does not report is that like Dravid, both Infy and TCS bounced back. One CEO went, Infy attracted another one. One Chairman went and Tata Sons found another. Life goes on.

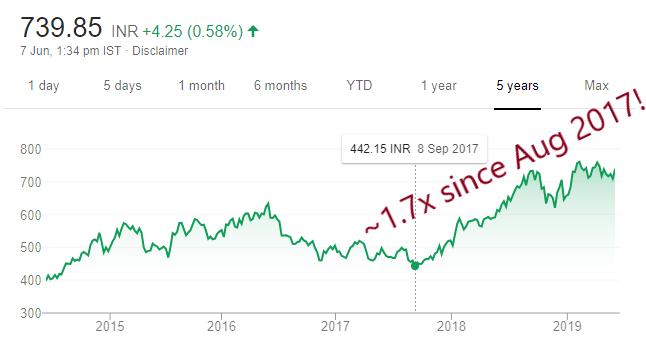

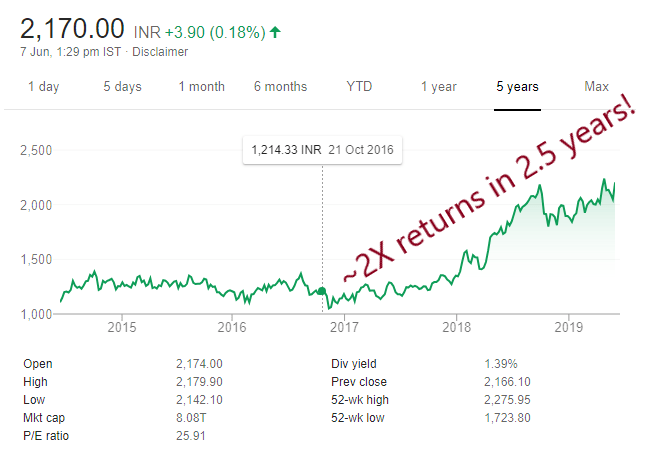

Now, if you and I had ignored the pundits and instead loaded up on Infy and TCS, we would have made a killing like this (~1.7 for Infy and ~2x for TCS):

I know you are probably thinking, that I conveniently picked companies that had bounced and ignore several others that failed. That is true!

But at the start of this blog, I gave somewhat of a checklist to think about such Dravid like situations and lets apply them:

Did the events affect the operating cash flow in any way?

No. There was no material impact and it was business as usual at all quarters. Selling, billing and collecting were going as usual.

Did the companies have debt or debt obligations?

No. Both were debt free.

Did the companies face risk to their revenue like customer exodus?

No.

Were the companies hit by any accounting scandal or fraud?

No.

Were there any other events causing fragilities like prices of raw materials going up etc?

No such events occurred.

My checklist is neither final nor fully formed. But I hope I was able to get across the point that it is our job to identify the Dravids of 2008 and back them. Yes, the quest for Dravids will lead to some Duds, but such is life. On the whole, it would be fun and rewarding!

Just to squeeze in Warren Buffett into the mix- this backing Dravid idea is somewhat similar to how Warren Buffett thought about the salad oil scandal at American Express. While everybody was pessimistic about Amex, Buffett did his own homework and figured that it was business as usual on the ground. He was so sure that he bet 40% of his portfolio on a single company and it was one hell of an investment for the Buffett partnership.

Cheers!

Hello Vikas,

Nice read. Thanks for sharing.

I agree on the operating cash flows and perception built by media on the risk.

Examples are not that convincing.

1. Infosys.

– How did CNX IT fare during the same timeframe. – almost same as Infosys

2. Tata sons example.

– While TCS did well other Tata group companies like tata motors and tata steel did not

While operating cash flow theory is fine. Both the leaders Cryrus and Vishal were at driving seat with passion and were replaced by unhappy oldies. While they survive in the short term they will pay for it in the long term.

LikeLike

Thanks Jesse. My point was that you would do well picking some “fallen angels”, provided they meet the basic criteria because the market forgets that they are fundamentally sound.

Regarding Infosys- I agree that Sikka was a fresh change. Huge I would say…like literally going from IE to Chrome. I know because I experienced it first hand. But I have also heard good reviews about the new CEO from my friends who work at Infy. So let’s wait and watch.

LikeLike