I was trying to teach my son some financial literacy. To make it easy for him to understand, I told him to imagine that there there was this big farm with lots of trees- Apples, Mangoes and Oranges. Since the farm was big, the landlord got two trained monkeys. And the job of the monkeys was to go and collect the fruits from the trees and serve them to him.

The first monkey climbed up the tree and ate all the mangoes he could and returned empty handed. Despite eating all the mangoes, he was still hungry and needed to be fed more fruits by the landlord.

The second monkey climbed up all trees and returned with a whole bunch of fruits for the landlord and the landlord rewarded the monkey.

The first monkey was a drain on the landlord’s resources. He was a liability.

The second monkey was a good return on investment. He was an asset.

Replace the following in the above story:

- Landlord = Owner/ share holder

- Monkey = Business

- Fruits = Cash/ capital

Assets produce cash. Liabilities consume cash. Therefore, in order to become rich, we need to collect more assets and reduce liabilities.

————–

While teaching this, it occurred to me that this is a good way to eliminate bad ideas. Let me explain this through two examples – Jet Airways and Infosys.

Jet airways may have been a good brand, but it definitely was a terrible investment.

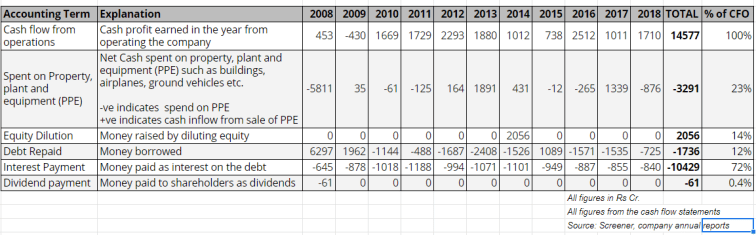

You can see that out of 100% of the operating cash profit:

- 23% went in acquiring buildings, airplanes, ground vehicles etc.

- 72% went towards servicing the debt

- 12% went in repaying debt

Now, all of the above accounts for 107% of the Operating cash profits. Since it spent more than what it earned, it went back to the owners and asked for more. And this “more” came by diluting equity.

Therefore Jet is a liability to its owners. Just like the first monkey.

Now, let me talk about a company that I have talked about in the past here and here– Infosys.

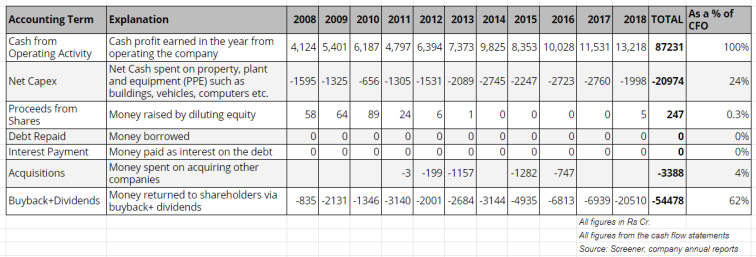

You can see that out of the 100% of the Operating cash profit:

- 24% went towards capital expenditure

- 62% went back to shareholders as dividends and buyback

Therefore Infosys is an asset to its owners. Like the second monkey.

Now, you’re probably thinking that all this monkey way of explaining is okay for a child but the real world works very differently, right?

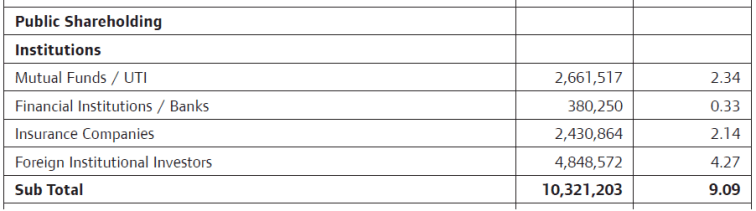

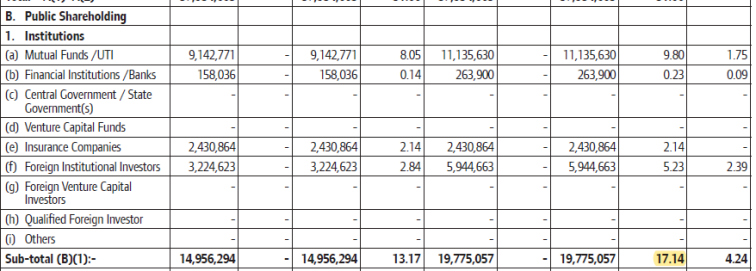

Take a look at the institutional holding in Jet Airways. They owned 9% of Jet in 2014…

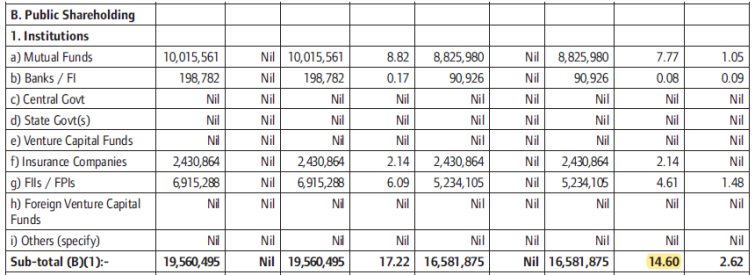

…14.6% in 2016…

…and 17.1% in 2018.

And what kind of returns did they see? About a total of 5% in 5 years! Considering that even fixed deposits would have fetched 40% in 5 years, the bright analysts lost 35% on Jet (relative basis). And didn’t get much dividends either. Whereas anybody who used monkey ideas and decided to stay away from Jet didn’t lose any money.

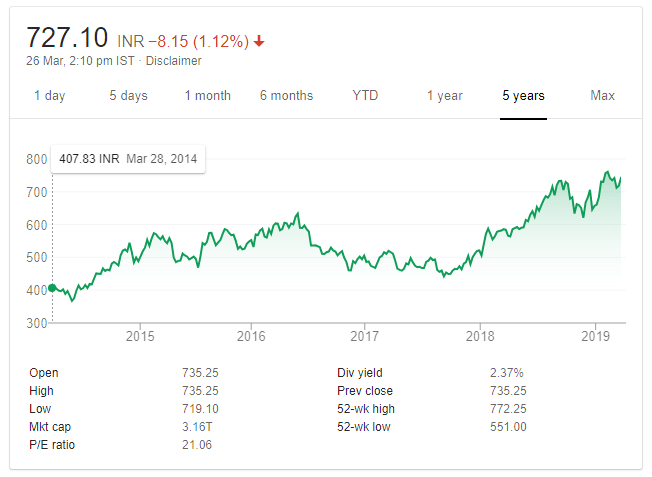

And this is how Infosys fared in the same period. Dividends and buyback would be over and above this.

Let me summarize:

- Assets produce cash for their owners. Liabilities consume cash from their owners.

- Assets can make their owners richer over time. Liabilities will make their owners poorer for sure.

- Assets become valuable over time. Liabilities become less valuable.

- Infosys is an asset. Jet Airways is a liability.

- Not losing money > losing money.

- Very bright analysts and fund managers forget the above simple lessons when managing other people’s money.

I tried, but I couldn’t resist what Charlie Munger may have told those analysts:

“It is remarkable how much long-term advantage people like us (Warren and Charlie) have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.”

Happy reading!

Very well written. And interesting too. Thank

LikeLike

Thanks Raghu uncle!

LikeLike

Superb !!

I would like to meet you.

LikeLike

Thanks! Please send me an email at vikasmkasturi@gmail.com.

LikeLike

Very well explained.

LikeLike

Thank you sir.

LikeLike

Thank you for the great post and your blog. I would like to know how did you fetch the data of acquisitions and buybacks for company for all years? as Current Annual Reports might not be having historical buyback amount and acquisitions.

LikeLike

Thanks Nihal. Sometimes I take data from screener.in and other times from the Annual reports. The former is easy and the latter is accurate. Depends on how enthused I am 🙂

LikeLike

Yes, in screener i didnt see buyback amount and acquisition amount while the rest of the data was available. As a company like infy goes about doing buybacks almost every year so we have to check in all those years annual reports how much buyback/acquisition had been done?

LikeLike

Yes Nihal. It’s best if you can take data from Annual Reports as it is complete. Even among the financial statements, my favorite is the cash flow statement.

LikeLike

Nicely explained….

LikeLike

Thanks Anant.

LikeLike