In some of my previous blogs, I have talked about rationality. But, what is rationality? It is the ability to make decisions based on first principles, mathematics, probability, available facts and not based on emotions and biases. Rational thinking leads to better outcomes in all professions. And as I discovered, rational thinking helps in board games too!

My son, his friends and I play a board game called Risk. It’s a game where you have to try and conquer as many territories as you can, which would give you more troops which will help you conquer even more territories. The incentive structure as described above gets you to attack more and take more chances- hence the name Risk.

Since we started playing this game, 8 months ago, I observed a few things such as -winning a difficult territory gives you a huge adrenaline rush. Losing a territory, leads to revenge-attacks because of deprival-super reaction tendencies. And, on the whole, we tended to rely on emotions and not probability theory, when deciding what to do. In short, I saw a lot of similarities between Risk and Investing. And I figured that what works in investing can work in Risk as well.

So I started to calculate probabilities of the attacker winning and based on that I decided what to do. I also realized that it’s sometimes better to give up a territory if it takes too many troops to defend against a determined attacker. The troops can instead be deployed more profitably elsewhere. Then I learnt that I must control my tendencies to revenge-attack especially if a prized territory has been taken away as the consequences may be disastrous.

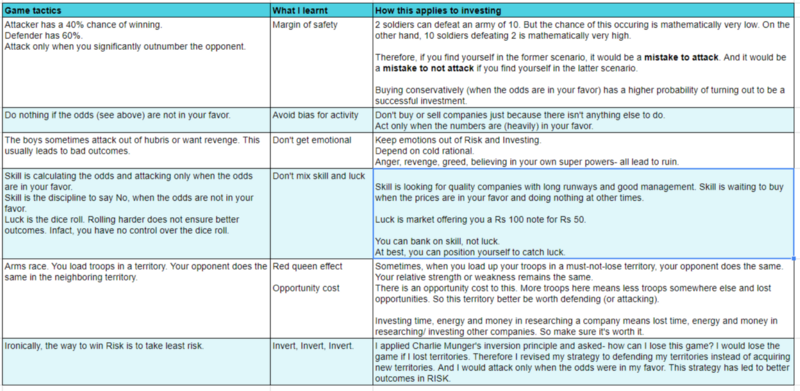

Below are a few of my observations and how I related them to investing.

Happy to say, that on the whole, the outcomes in Risk started to get better as I started to play more conservatively. I wish to do the same consistently in my investing process as well.

Cheers!

One thought on “A few lessons from the board game ‘Risk’”