The stock market is a wonderful place to find compounding machines. All companies are in effect a compounding machine. They take capital in the form of owner’s equity and debt, compound this capital and throw out profits. The best companies to own are the ones that take in the least amount of input capital, generate the most amount of profits and can reinvest those profits back in to the business and throw out even more profits the following year and so on for long periods of time.

Once in a while, the stock market gripped by fear, misprices such wonderful compounding machines and offers them to you at wonderful prices. If you find one, add it to your portfolio and let it compound capital for you.

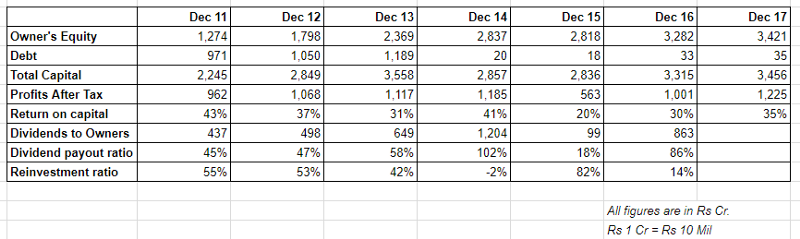

Take the case of Nestle India. In Dec 2011, the Owner’s Equity was Rs 1,274 Cr, Debt was Rs 971 Cr and it generated Profits of Rs 962 Cr, generating a return of 43%. Of the profits, it reinvested about 55% and the remaining 45% was paid to owners as dividends. As you can see, it generated high rates of return on the capital employed in each of the following years and paid its owners rich dividends and reinvested the remaining back into the compounding machine.

Notice that between Dec 2011 and Dec 2017, the Owner’s Equity had swelled by 2.7 times.

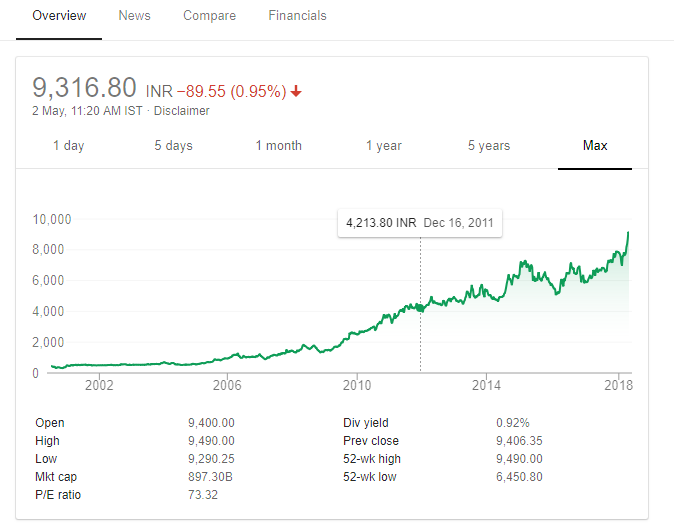

Now let’s see how the market has rewarded the shareholders of Nestle India. In Jan 2012, the price of 1 share was about Rs 4213. Today (May 2018) that same share is worth Rs 9317, giving a return of 2.2 times or roughly about the same as the growth in owner’s equity.

Its not the financial news, your broker or your know-all financial adviser but Time that is the friend of a wonderful company. The wonderful company usually compounds at high rates and over long stretches of time, the owners are richly rewarded for their patience!

Disclaimer: No position in Nestle India.