A word: In investing, everybody makes mistakes. But the difference is – the rookies make costly and lethal mistakes while the better investors make fewer and cheaper mistakes. I have listed some great investors below and their publicly acknowledged mistakes – particularly to do with selling. I hope we can learn something from the masters about how to make fewer and cheaper mistakes.

—

In investing, the windshield is foggy and the rearview, crystal clear.

In 2008, Prof. Sanjay Bakshi bought shares of a company at Rs 200 per share. The company was cash rich and cash itself accounted for Rs 147 of cash per share. He tendered some of the shares at Rs 691 in a buyback and the rest he sold it for Rs 600 in October 2009. In all he made 3X his investment in just 1 year! But cashing out turned out to be a terrible thing to do because that company was Eicher Motors and today it’s corresponding share price (assuming no split) would Rs 53,000 and counting! So if he had invested Rs 1 Cr in October 2008, today it would be Rs 260 Crs! Source.

Mr. Sunil Singhania, when he was in Reliance Mutual Fund purchased Bajaj Auto when it’s market cap was just Rs 400 Cr. Not only were they one of the early ones to buy they were also one of the early ones to sell. Today Bajaj Auto’s market cap is Rs 2 L Cr and counting. So, the Mutual Fund would have made a 500X on their investment if all they did was not selling. Source.

In a podcast interview, Mr. Prashant Desai says how he bought Titan when Mr. Rakesh Jhunkhunwala bought it. But he sold it when it went up 3 X despite RJ telling him not to. That investment alone would have been worth Rs 200 Cr for Mr. Desai, if only he hadn’t. Source.

Mr. Swanand Kelkar, a former fund manager at Morgan Stanley, purchased Bajaj Finance at about Rs 700 per share in 2012 and sold it for Rs 1400 within 10 months. Today, each share of Bajaj Finance trades at Rs 84,000 (not adjusting of split and bonus). That was a 120 X miss! Source.

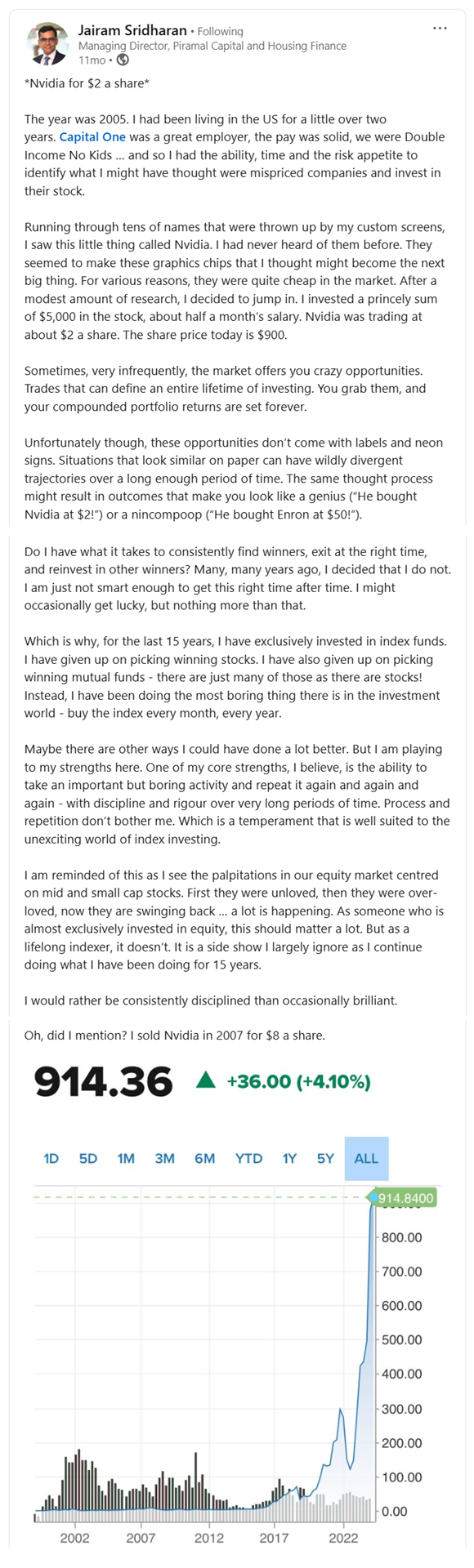

And finally, a picture that is worth 560 X.

Now, if you are leaning towards never selling, you should read the following anecdotes too.

In 1988 Warren Buffett purchased Coca Cola at about $3.25 per share. From 1988 to 2000, Coca Cola went up to $27 per share at about 20% per annum. From 2000 to 2025, Coke has gone up to $71 per share at a rate of just…6.5%. In other words Coke was a great investment for the first 12 years and not so great for the next 25!

During The Great Bubble, market-value gains far outstripped the performance of the businesses. In the aftermath of the Bubble, the reverse was true. Clearly, Berkshire’s results would have been far better if I had caught this swing of the pendulum. That may seem easy to do when one looks through an always-clean, rear-view mirror. Unfortunately, however, it’s the windshield through which investors must peer, and that glass is invariably fogged.

Warren Buffett reflecting on his not selling during the crazy Dot Com boom. 2004 Letter to Shareholder

At one point of time, Ajay Piramal was the man who could do no wrong. Between 1988 and 2011, he compounded wealth at 28% per annum. Between 2011 and and 2018, he compounded at the rate of 32% per annum. However, from 2018 to 2025, it has been almost -10% per annum. So not selling in 2017 or 2018 would’ve been expensive.

In the same podcast interview as above, Prashant Desai also talks about Kishore Biyani – the father of modern retail in India. In 2002, market cap of Big Bazaar was Rs 52 Crs which went 1000 X in 5 years to 52,000 Crs. Big Bazaar was also carrying a lot of debt. If Biyani had diluted equity and used it to reduce debt, Big Bazaar may have survived. But his response was: I will get a better price tomorrow. One fine day, the stock price didn’t go any higher.

—

Let me tell you my own two experiences. In reality there are a lot more but I am limiting to two because it’s too painful to recollect and write :).

I first came across IEX in 2018 and I loved the business. I had a mental model where if a player is growing faster than the market then it means he is taking market share away and hence he is the player to bet on. So I had been buying IEX from 2018 to 2020. Then Covid happened and the markets went crazy. So crazy that what I had purchased for Rs 40 odd went up to Rs 300 in Nov 2021. And I said, what if this is the Prof Bakshi and Eicher moment…why sell a great business and then regret forever? However, the stock price came down as quickly as it went up and today it is about 50% of it’s high. If I was worried about selling and regretting forever, I have so far regretted not selling for just 3 years!

In 2019, I came across another exchange – BSE. If IEX had 85% market share, BSE had 5% share in the equity derivatives (not counting Star MF). But in 2018, it was trading below the cash on it’s book and seemed like a decent bet. I even tendered shares in the buyback in 2019 and my average buy price came to some Rs 170 per share. In Feb 2022, that share zoomed to Rs 900 per share and I again felt that same feeling – Prof Bakshi and the Eicher moment. And this time too, the price came down to Rs 450 within a few months. Prof Bakshi- Eicher moment turned into regret filled Vikas-IEX moment again. But by March 2023, the share price was back to Rs 900 and I proudly sold 50% of my shares. And then I watched the share price go up, up and up to Rs 2200 per share at which time I sold the other 50%. And then, instead of coming down, it kept going up all the way to Rs 6000 per share. I could’ve had a 35 bagger! Knowing that the price has come down to Rs 4100 today brings some solace to me. (You see, not everybody is unhappy when a share price falls.)

That’s the story of my two exchanges. The one that I truly loved, hasn’t moved. The one I that I sold for a gain has given me only pain.

At the time I was in love with IEX, I was having another love affair with Thyrocare. Here was the world’s lowest cost diagnostics lab with probably one of the highest return on capital in that business (40%+). And my love was so undying that in my mind I was saying the vows of till-death-shall-do-us-apart. But unlike me, the founder didn’t suffer any fools. He promptly sold the company and so did I. So here I was thinking of “hold forever” and there the promoter was tweeting “#AnotherEpicExit”. This was one of the rare times when I got the timing right. However, my feelings at that time were nothing epic…it was more like “#HeartBreak”.

—

Let’s take the example of Big bazaar which went up 1000 X (according to Prashant Desai) between 2002 and 2007. Selling in 2005 would’ve been a mistake. Not selling in 2007 would’ve also been a mistake. Likewise, selling Piramal in 2015 would’ve been a mistake and not selling in 2018 would’ve also been a mistake. Or the opposite for Buffett. Not selling in 2000 was a mistake and holding it since, another mistake.

Everything I am telling you is all in hindsight and when we look at things in hindsight we have 20 20 clarity. But when you are in front of your computer about to hit the sell button – there are a million possibilities ahead of you and you don’t know which one will play out. To make matters worse, there is an excess release of dopamine in the brain and emotions like FOMO and ROMO run high.

However when you look back, just one of those million possible outcomes has played out. And now it becomes easy to judge. I used to think how could Prof. or Buffett make such a mistake until I made worse mistakes myself.

So, if there is a takeaway: it is that selling is much, much harder than buying. And investing is all about learning to make fewer and cheaper mistakes.

In investing, the windshield is foggy and the rearview, crystal clear.

Hi Vikas,

For me, the lesson is this: the cost of selling was higher than the cost of not selling because the returns from multibagger stocks are so high. Having just one or two such stocks in a portfolio of, say, 20 stocks would offset the mediocre returns of the other stocks.

Therefore, once we identify and buy, let’s say, 20 stocks, it’s better not to touch them for 10 years, regardless of the circumstances (sell only for fundamentals reasons), as some winners will likely emerge from the portfolio. I would like to know your views on this strategy and how you handle your portfolio currently.

LikeLike

Hi Vasanth, Thanks for your comment. You may want to do some back testing of many cases. I would also be interested in knowing the outcomes.

LikeLike

The problem with back testing is, we could be biased choosing a 20 stock portfolio and running them for next 10 years.

So the way we can do this is, by asking people who actually did this from past 10 years or so. And those people should be reasonably good investors to begin with. We cannot ask invetsors who invested in random stocks based on tips and did not touch it for ten years.

So few people come to my mind.

One is Nalanda capital. And in this article, Anand says, they sold very rarely but in hindsight not even selling those would have lead to much better returns.

https://buggyhuman.substack.com/p/do-nothing-dammit

The other person is Vishal from Safal Niveshak. In the below article, he explains his investing style and how he sells very very rarley.

https://www.safalniveshak.com/how-i-invest/

And may be Prof. Bakshi too sells rarely as per this article.

https://www.safalniveshak.com/email-exchange-with-sanjay-bakshi-on-valuations/

LikeLike

Hi Vasanth – it’s a good idea.

In investing, outcomes are path dependent. If you are hold for shorter time periods you will have one kind of outcomes (good and bad) and if you hold for long periods, you will have another kind (good and bad).

Better to try everything before settling on anything.

LikeLike

Hi Vikas,

I agree. It is really difficult to settle on one strategy without trying various approaches.Only after some years will we know what kind of strategy suits our personality, and then we can pursue that.

Also wanted to know your views on gold as an investment/hedge. I feel gold is the only safe hedge against governments printing money as even debt funds cannot save us here. Would you agree on something like gold being 20 to 30 percent of the portfolio as a safe bet? Thanks in advance.

LikeLike

Vasanth – Maybe gold is a good investment strategy, but I don’t know enough. I am trying to specialize in equities only.

LikeLiked by 1 person