We accumulate ideas, but we are bad at letting go of some old cherished and beloved ideas. What may have been common wisdom for our parents’ generation does not have to become wisdom for us by default.

I once met a man who said that his father forbade him and brother from all forms of gambling: no card games, no investing in stocks. Life is so full of randomness and thinking probabilistically is a very important skill. If you don’t play card games, how else will you experience probability theory? Unwillingness to let go of old ideas is one reason why that man was poor.

Nikolai Tesla discovered Alternating Current while working for Thomas Edison. The new and better idea was right under Edison’s nose. But because Edison was so in love with Direct Current, he couldn’t see/ didn’t want to see the benefits of AC current for long distance transmission.

Warren Buffett became a millionaire by his 30s investing the way his guru Ben Graham taught him. But if he hadn’t learnt a better way to invest and let go of old ways, he wouldn’t have become a multi-billionaire.

Whatever your profession be, if you want to progress you have to keep learning and keep letting go of old, cherished ideas. You have to be ruthless.

Charlie Munger used to say:

Part of the reason I’ve been a little more successful than most people is I’m good at destroying my own best-loved ideas.

—

In 2017, I was just starting out as a full time investor. I was nervous, scared and impressionable. An idea somebody planted in my head was to avoid investing in companies that sought additional equity capital. His idea was that: companies must send shareholders cash and not the other way around.

In 2025, I am willing to let go of this idea.

—

A company that helped change this notion for me is Gokaldas Exports (Gokex). In 2017, Gokex was taken over by a new owner and a new management. I knew nothing about this company until 2021 and I only invested in it as an experiment. I was skeptical for the most part of last 3.5 years. It was only when I took a step back and decided to pay more attention to what the management was doing, was I positively shocked.

As you can see from the table below, the company has used Equity dilution as route to raise capital. But what has it done with this incremental capital? It has used it to add more plants and machinery (Capital Expenditure) and used it to acquire smaller less efficient players. And it hopes to turnaround the smaller companies and bring their efficiency on par with itself.

In the last 6.5 years, its sales have increased 3X (because of the acquisitions and capex) , its net profits 5X (because of efficiency) and its market capitalization some 12 X!

The larger point I am trying to make is equity dilution per se is not a sin (unlike the notion I carried in my head). You need to see what the management do with the new capital. I love it when managements take a long term view and invest it for future growth because that is what creates value for the shareholders in the long term.

Now, unlike Gokex which invested the money into growth initiatives, I think Vodafone Idea is raising money just to survive. And hence there may not be value creation for shareholders. I have been publicly skeptical of Vodafone Idea, since 2019, and their turnaround efforts despite infusion of a lot of capital in the form of equity and debt. So let’s see if they prove me right or wrong. Either way, it will be fodder for a future blog. 🙂

—

I have no product or service to sell, hence I am not doing content marketing (subtle insertion of an ad). I picked Gokex only as an example to illustrate that it can be very rewarding if you learnt to let go of incorrect or outdated ideas. Be more like Buffett and less like Edison when it comes to cherished ideas.

—

What if the idea you destroy today turns out to have been the right one? Simple! Adopt the idea again. Take a detached view of ideas. If they appeal, adopt them. If you realize they are not right or outdated, discard them. If they re-appeal, adopt them again.

A friend of mine who was a very big proponent of vegan food is now no longer vegan. He was willing to change his mind given new facts and experiences, and that is highly, highly commendable. That is the kind of mind we want.

If people laugh at your change of opinion, laugh with them. But the joke is on them because they are yet to see the wisdom of your choices.

—

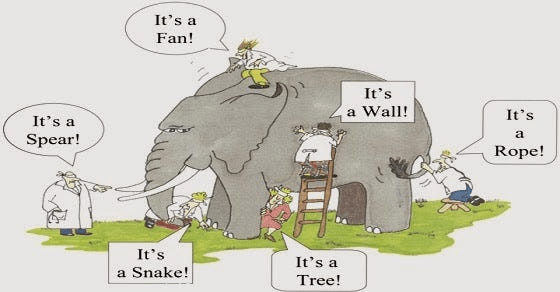

I think of myself as a blind man touching an elephant. But unlike the blindmen of Indostan, I wish to keep moving and not being stuck to my old notions. So sometimes I may call the elephant as a snake, sometimes as a tree and sometimes as a wall. I want to keep changing my opinions as new information comes in. Even if I am periodically wrong, this is more fun than staying stuck in one position.

So, dear reader, what idea did you destroy?

PS: Featured Image Source: https://medium.com/betterism/the-blind-men-and-the-elephant-596ec8a72a7d

Hi Vikas,

One more article well delivered. So, nothing is necessarily permanently good or bad. It is better to keep evaluating things all the time – I would consider it as akin to AUTOFOCUS in a CAMERA, it keeps on refocusing as the subjects in the view change. So, Keep oneself in Autofocus mode – this is my take – which I could change tomorrow 🙂

Bhai

LikeLike

Thanks Bhai. I didn’t know autofocus worked that way…but good analogy

LikeLike

Good article Vikas !

LikeLike

Thanks Vasanth

LikeLike