I read this book – Game Theory and I loved it! In fact, I loved it so much that I read it twice. What is Game Theory? According to the book:

Game theory allows us to understand how people act in situations where they are interconnected.

Game theory applies to business and life as it shows how rational people end up making sub-optimal or irrational choices when dealing with each other. Here are some type of games.

- Prisoner’s Dilemma

You may have heard of the famous prisoner’s dilemma. Two prisoners- Ram and Shyam are being interrogated separately by the police. Both are rational and smart. The police inspeactor approaches them separately and makes identical offers to Ram and Shyam. It would be like:

If:

- Both Ram and Shyam confess => both get 10 years

- Ram does not confess but Shyam confesses => Ram gets 15 years in jail and Shyam goes free

- Ram confesses but Shyam does not confess => Ram goes free and Shyam gets 15 years in jail

- Neither Ram nor Shyam confesses => Both get 1 year in prison

The offers are identical, but they aren’t allowed to discuss. And they need to take an option. But, which one?

The payoff matrix would be like this for both:

Like I said, both are rational and smart. And both can visualize the payoff matrix. And they quickly figure out that their best interests lie in confessing (and hoping that the other does not). Remember, incentives are a superpower and if there is one thing people understand really well, it is their own incentives or interests.

As a result, both Ram and Shyam are likely to confess and go to jail for 10 years rather than both not confessing and going to jail for just one year.

Companies that operate in a commodity like environment face the same dilemma. Commodity prices follow the law of supply and demand.

- When demand > supply, prices are high.

- When demand < supply, prices are low.

So as a whole, it is best for the commodity industry that demand > supply.

Now, each company is smart and rational and can figures out for themselves that:

If it increases capacity:

- Best case scenario: gain market share

- Worst case scenario: maintain market share

If it does not increase capacity:

- Best case scenario: maintain market share

- Worst case scenario: lose market share

Payoff matrix of a commodity company

What do you think will happen? Almost every company is going to increase capacity to maximize their own profits and as a result, the industry goes to a state of excess supply which leads to lesser future profits for everyone. As a group, they are worse off in the future.

In the 1960s and 70s, Berkshire owned a textile mill and it had commodity like charcteristics. In the 1985 letters to shareholders, Warren Buffett explained the prisoner’s dilemma like attributes. (I have omitted some text and highlighted others.)

Over the years, we had the option of making large capital expenditures in the textile operation that would have allowed us to somewhat reduce variable costs…But the promised benefits from these textile investments were illusory. Many of our competitors, both domestic and foreign, were stepping up to the same kind of expenditures and, once enough companies did so, their reduced costs became the baseline for reduced prices industry wide. Viewed individually, each company’s capital investment decision appeared cost-effective and rational; viewed collectively, the decisions neutralized each other and were irrational (just as happens when each person watching a parade decides he can see a little better if he stands on tiptoes). After each round of investment, all the players had more money in the game and returns remained anemic. Thus, we faced a miserable choice: huge capital investment would have helped to keep our textile business alive, but would have left us with terrible returns…A refusal to invest, however, would make us increasingly non-competitive, even measured against domestic textile manufacturers.

This same self-maximization can be seen when we share a common resource.

- Think of Farmers that graze their sheep in a common grazing land. The resource (grazing land) is common and therefore in the long term interests its best to keep a check on the number of the sheep grazing. But, individually each farmer gains more by having more of his own sheep and is worse off if others increase their sheep while he doesn’t. As a result everybody overgrazes and therefore the status of the common resource diminishes faster and as a result everyone is worse off in the future. Similarly, think of fishermen fishing in the seas.

- When a large group of people meet over dinner at a restaurant and decide to share the bill, each of them will tend to over order as the bill is being shared and therefore as a group they would end up spending more than what they would have if they had paid their own bills.

- Traffic is notorious in Bengaluru. Therefore in order to beat the traffic, everybody starts sooner to beat the traffic and as result, the traffic jam starts sooner in the day. (To compound matters, the vehicular population has been increasing too, so the jam starts sooner and lasts longer.)

- Another manifestation of this is the arms race. One country increases its defense budgets and so it’s neighbors have to increase their budgets else they would be at a disadvantage. As a result, both countries spend tons of money on defense and as a result, neither gains any advantage and the status quo is maintained. Now, that same money could have been spent on healthcare, education or public infrastructure instead gets spent in piling up arms without any incremental advantage and therefore both countries are worse off.

2. Zero Sum game

Another form of game theory is zero sum games. In a zero sum game, a win for A would mean a loss for B.

Say there are only 10,000 customers in a town and two grocery stores. Therefore, if one store gains a customer, it would be a loss for the other and therefore both stores would be very protective.

Buying-Selling is an example of zero sum game. A 1 Rupee gain for the buyer is 1 Rupee loss for the seller. And vice-versa. Therefore, neither is likely to give up easily.

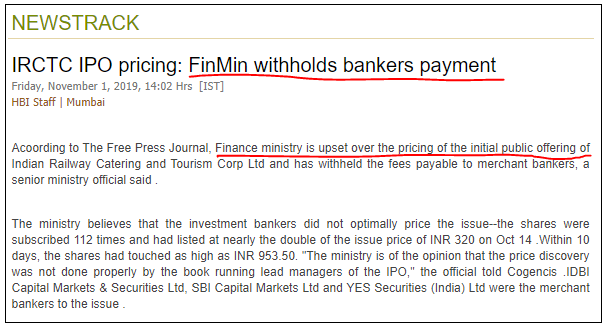

Recently, IRCTC came out with its IPO. The share price opened up at Rs 320 and within 10 days it was at Rs 953 (3X). Some commentators were saying that it was nice on part of the government to leave money on the table for the small investors. That is BS! No seller, even the government wants to leave money on the table. Money left on the table for investors means money lost for the promoter. And the promoter is angry with the merchant bankers for leaving money on the table.

3. Ultimatum Game

Then there is the ultimatum game. Here, there is a proposer and responder. The proposer has a sum of money and he has to make a proposal to the responder on how it is to be shared. If the responder accepts the proposal, they proceed to share it as per the proposal. If the responder rejects it, then neither of them gets anything. Therefore the proposer needs to think and evaluate carefully about what to propose.

Rationally, even if the proposer were to offer to keep 99% and give 1% to the responder, the responder should accept because he would be better off with it than without it (1% > 0). But in reality, most responders want a “fair” deal.

Think of the delisting process in India. A company that wants to delist from the stock exchange needs to follow the Reverse Book Building process. As per this process, all shareholders provide their bid at which they want to delist and the price that is suitable to 90% of the investors is taken as the discovered price. The promoters backing the deal can accept, reject or make a counter offer to the discovered price.

If you frame it in as per the ultimatum game, the promoter (proposer) needs to make a fair counter offer to the shareholder (responder) else it would be rejected and both of them would stand to lose.

If you like puzzles, here is a version of the ultimatum game. Can you solve it?

(Hint: work backwards.)

—

The best way to learn something is to think about, talk about it, write about it and maybe even teach it. I started seeing these patterns everywhere and hence this blog. Thanks for reading!

(Featured Photo source: Photo by Margarida CSilva on Unsplash)

2 thoughts on “Game theory”