Ben Graham was the OG of Value Investing and teacher and mentor to Warren Buffett. (OG is Original Gangster; that is young people’s lingo for the original, authentic superstar.) He was the first to figure out there is a method to investing and that you and I can profit from the stupidity of the market.

—

In the short run, the market is a voting machine but in the long run, it is a weighing machine.

-Ben Graham

Graham said that in the short term, stocks are like a popularity contest. The market chases what is the flavor of the season. But in the long run, the stocks that do well are the ones that grow their profits and cash flows substantially.

While Graham said this many, many decades ago, it is still as true today. For example: in 2020 and 2021, platform companies and fintechs were all the rage; then in 2023 and 2024, railway and defense companies were the hottest companies. Now, it is all AI and data centers…or so it was when I started writing this blog. As long as it holds the market’s fancy, these stocks will trade at sky high valuations. After that…

At the same time, good companies belonging to other industries are ignored, some more than others. For example, in 2020 and 2021, while platform and fintech companies were soaring, PSUs were ignored so much so that some were trading at 6 to 7% dividend yield! But then, these same companies’ stock soared in 2023 and 2024.

Let me share a somewhat funny anecdote.

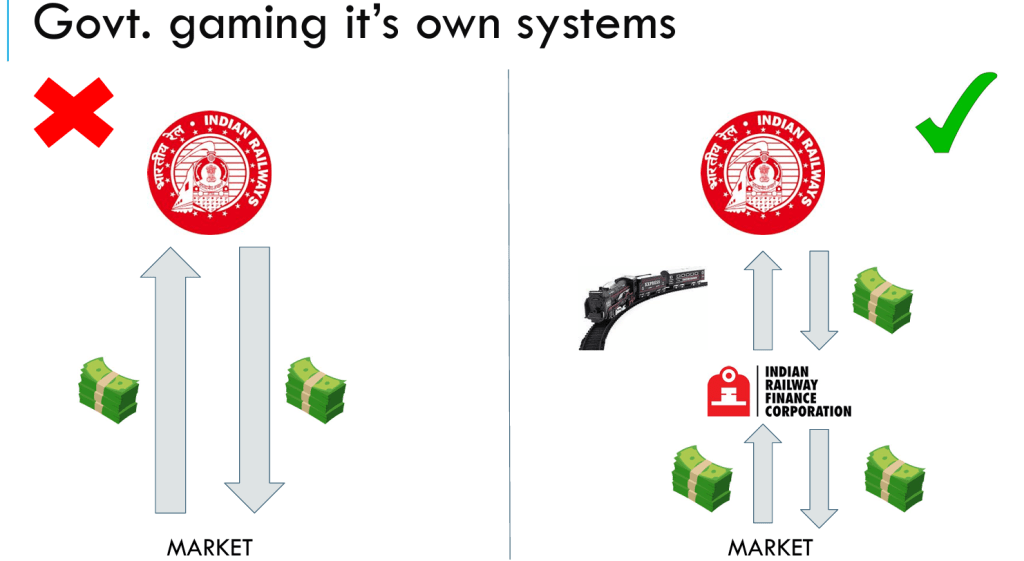

There is a company called IRFC. It exists solely for one purpose. Per the law only the Ministry of Finance can borrow money from the market. But then the Railways needs money too, to buy locomotives, add coaches, add tracks and stations etc. So the Railways created this entity called IRFC; IRFC borrows from the market and buys assets (like say Vande Bharat trains) and then leases it out to the Railways. The Railways pays a lease rental to IRFC which which IRFC then uses to service it’s debt.

So technically, the Railways is not paying interest; it is paying lease. Railways is not borrowing…IRFC is. Yeah, right!

Somebody once said: don’t do indirectly what you shouldn’t do directly. Railways chose to ignore that memo!

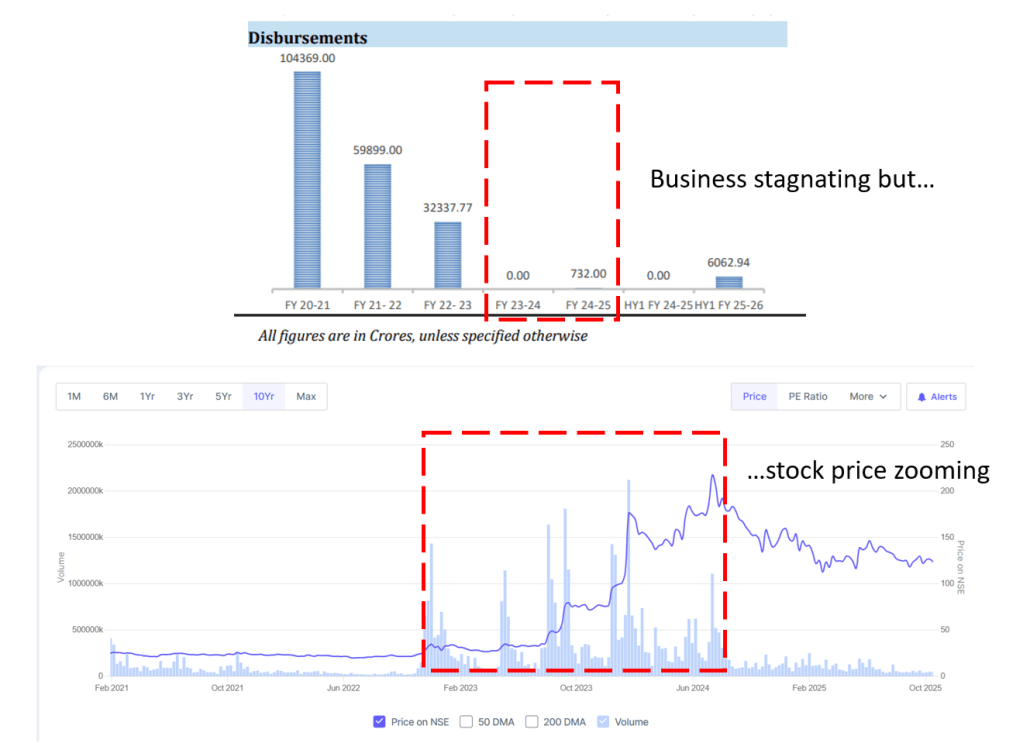

IRFC got listed in 2021. Remember, at that time, the market was in love with Fintechs and Platform companies. So IRFC was valued at something like 0.5 times Price to book and paid a dividend yield of nearly 6%! But the market took a fancy to it sometime in 2023 and 2024 and the price went up 10X!

Here is the funny thing that happened. The railways did not borrow any money from IRFC for about 2 years and the 10X happened in those years! First the market ignores a somewhat good/ fantastic company and then it falls in love with it, just when the business was stagnating!

As you can see – in the short run, it’s a popularity contest.

Similarly, I am told that Palantir Technologies trades at 100 X sales and 600 X profits! That means it would take 600 years for today’s profits to payback the price of the company! At the height of the Dot Com boom, Infosys was trading at 200 X profits! Would you say, these kinds of valuations is rational or irrational?

Even if you buy a fantastic business at those kind of prices, chances are that you will not make much returns on your investments for a long time. Therefore I am going to say it again: in the short run, it’s a popularity contest. It’s not about fundamentals of the business; it’s about market’s fancy towards an industry or a company. If you hold those shares, sell them now. If you want to buy them, don’t.

Now, the opposite also happens, where a business is fundamentally improving but the market totally ignores it. This is the pond where I like to fish. (See my blog on Directional Change.)

The market is irrational at the extremes. Good companies are ignored by the Market and therefore they are available at dirt cheap prices; and at the other extreme, the same companies trade at sky high valuations despite lousy or so-so fundamentals! This kind of irrational behavior is what Ben Graham called Manic – depressive. When Mr. Market is exuberant he will offer to buy your share of the business at a sky high valuation; when he is depressed, he will offer his share of the business at depressed prices.

Therefore, what should you and I, do?

- When Mr. Market is depressed, buy from Mr. Market. Or buy good companies that Mr. Market is ignoring right now.

- When he is exuberant, he is going to offer a great price for your shares. Sell it to him.

- Repeat to get very rich.

—

In the long run, the market is a weighing machine.

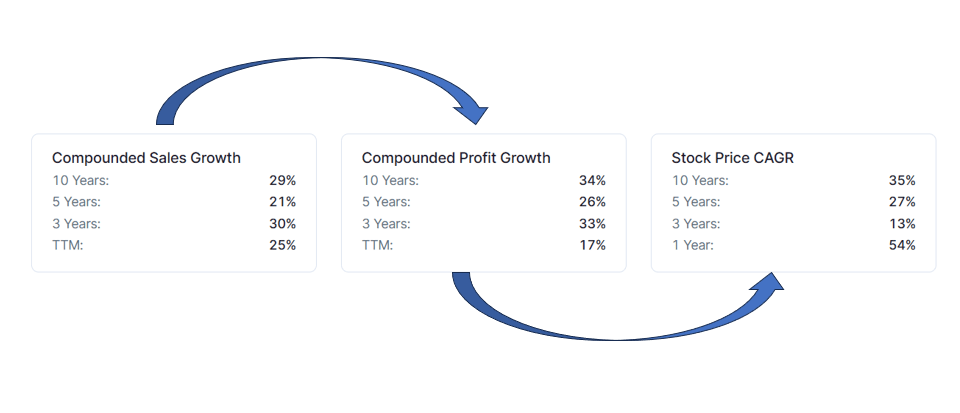

Once in a while, you can find a company that can keep growing for a decade or longer. Sales growth leads to profit growth which leads to the stock price growth over a decade.

Here is Bajaj Finance that has grown consistently in almost every time period. If the stock price compounds at 35% for 10 years, your investment multiplies by 20 times! In the short run, the market may temporarily misprice such a company, but in the long run the price reflects the growth in business and profits.

When to hold and when to fold?

That is, how do we know something is worth keeping and something worth selling? Something I am realizing right now is that if the stock price runs up very quickly without any fundamental change in business, then it is probably better to sell. What goes up quickly, is likely to come down quickly as well. But if the business is solid like Bajaj Finance AND is investing in it’s future growth then it’s better to hold. Unless, of course it starts to trade at 100 X earnings.

On the other hand, if you owned IRFC and it went up 10X but you know that disbursements have been 0 and therefore there isn’t likely to be short term growth, and sooner or later the market is going to find it out – it’s better to sell.

You see, at the extremes, the market is irrational. But in the middle, it is quite rational.

—

Let me summarize this post:

In the short term, it’s a popularity contest. What is popular now, may be different from what maybe popular later. And prices may be completely detached from fundamentals. Gold can trade at the price of dirt and dirt can trade at the price of gold. Eventually, such crazy periods will come to an end.

In the long term, growth in share prices happen for only one reason: growth in profits. And only good or great companies can keep growing for a decade or longer. Others tend to flounder.

Develop different frameworks for thinking about short term opportunities vs long term opportunities. Don’t hold when you should sell and don’t sell when you should hold.

Become a skeptic. That is, don’t accept everything at face value. Right now everyone is focusing on the I in AI; very soon we may learn more about the A in AI. Here is a table I asked ChatGPT to generate.

—

On that sobering note, have a good day!

One thought on “Voting machine vs weighing machine”