Jesus used simple everyday stories to communicate his message. Here is the Parable of lost sheep.

Suppose one of you has a hundred sheep and loses one of them. Doesn’t he leave the ninety-nine in the open country and go after the lost sheep until he finds it? And when he finds it, he joyfully puts it on his shoulders and goes home. Then he calls his friends and neighbors together and says, ‘Rejoice with me; I have found my lost sheep.’ I tell you that in the same way there will be more rejoicing in heaven over one sinner who repents than over ninety-nine righteous persons who do not need to repent.

After that religious discourse, let’s switch to the main course: investing.

Different investors have different ways of investing. Some look for growth, some look for value, some others look for momentum. Some have a shorter time horizon, some have longer. Some try to know everything about one sector, some others a lot about lot of sectors. In short: different folks, different strokes.

As an investor, I don’t have any one style. I am little bit here and there kind of investor. However a theme that I like and I am trying to build some competence is: betting on change.

The template is something like a Bollywood movie: there is a lousy business. And some new management team takes over. The new managers make better business decisions, they infuse their own money into the business (equity), they work on reducing debt, lowering working capital, investing in new capacity etc. And then the profit starts to jump. The stock price starts to march upwards. The market finds greater joy in the sheep that returns to the fold!

When I first started investing as a career, I was focused on finding businesses that were already good or great. Now, I am okay investing in lousy businesses that are becoming good or good businesses that are slowly going towards greatness. I now think it is more rewarding to bet on change.

An example.

Here are two companies A and B from the same industry. A is a high quality business. B on the other hand was a lousy business until 3 years ago. What happened? A new new CEO took over B and has made some changes like the ones I mentioned above: focusing on higher margin products, reducing debt etc. all of which has caused a 27% CAGR growth in profits! If you invested in the better quality company A, you got good and steady 28% CAGR returns. But if you invested in B, you got rewarded 62% CAGR!

Like the shepherd, the market rejoices about the found sheep (Company B), rather than the 99 that were already at hand (Company A).

A rational economist would scratch his head and say: this is irrational. But you and I can not only be rational but also put the irrationality of the market to work in our favor.

—

In Physics (and/ or Math) we learnt the concept of Scalar and Vector. A scalar only has magnitude. A vector has magnitude and direction.

Speed is a scalar, because it tells you how fast you are going. Velocity tells you how fast and more importantly in what direction you are going.

I believe direction is most important; fast or slow is secondary.

In investing, what is this “right” direction?

When a company starts to move in the right direction there are a few noticeable improvements. It’s sales and profits start growing faster, it’s cash flows improve, it’s debt reduces, it has higher margins and higher profits, it becomes more efficient at deploying capital as measured through working capital days, ROCE, ROE etc.

Below are some patterns that I look for.

Balance sheet changes

- Equity increases

- Either through accrued profits or promoters putting up more money (skin in the game)

- Debt reduces

- Sale of non core assets

- This increases cash on hand

- Reduction in working capital

- This also increases cash on hand

P&L changes

- Sales growth

- Operating leverage plays out.

- EBITDA margin and PAT margin increases faster than the Sales.

- Interest cost reduces.

Cash flow changes

- CFO increases through higher profits and through reduction in working capital.

- Investment in property, Plant and Equipment

- This is like adding capacity for future growth

- Debt repayment

Business decisions

- Cutting down on loss making businesses.

- This may seem obvious, yet businesses seem so unwilling to exit loss making businesses. For example – Club Mahindra, has been so reluctant to sell it’s loss making subsidiary and many hundred Crs more must be lost before they do the right thing. Aditya Birla has been unwilling to simply pack up Vodafone Idea and instead keeps putting up 10,000s of Crs into it.

- Sale of non core assets

- Focus on products or services with higher margins, where they have a right to win

- Company begins to have earnings calls, earnings presentations, media interactions etc. These are all signals that the management is gaining confidence and is now willing to answer tough questions.

- Company starts to attend industry events like trade shows. It signals to customers and partners that the company is open to business.

- Senior management appointments, additions to sales teams, addition of branches, distributors and dealers, investments in advertising etc. All of these are investments in future growth of the company.

- Company brings in consultants to help them improve their business functions like supply chain or operations etc.

- Company starts to sign up more partnerships for product R&D, for sales etc.

- Company pays a dividend after a long time

- Change in product mix. Selling products with higher margin will lead to higher operating profit which can lead to higher Operating leverage.

- Lowering Related Party Transactions, Inter Corporate Deposits etc.

- Adding distribution. More distribution and sales people can lead to higher sales and profits.

- Reducing working capital. S Chand’s receivables and inventory days were 300 days and 400 days resp. in 2019 and are now 140 and 220. This means profits on paper are getting converted to cash in hand faster. It also means that the company is more efficient and needs lesser capital.

- Reducing NPAs. Many lending businesses learn some basic lessons after burning their hands. So, it is very exciting to see some businesses making amends and correcting their NPAs, their ALMs, their underwriting etc.

—

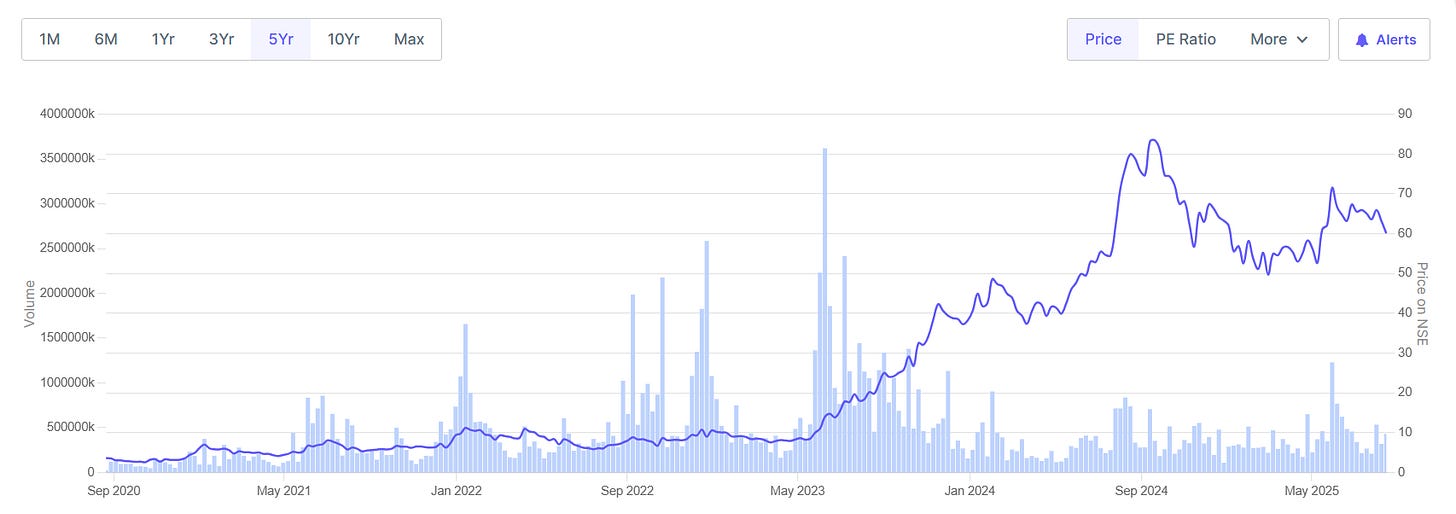

I’ll just illustrate this with an example of Suzlon. I missed investing in this company because I didn’t trust my own intuition.

In early 2023, I did some homework on Suzlon and it was a lousy business. Not only that, it had a massive debt and it had defaulted on it’s repayments sometime in 2020. But then something remarkable happened. They managed to convert the debt to equity and they infused more money through a Rights Issue. And then around that time the government also changed regulations with respect to reverse e-Bidding. It was like all stars aligned for Suzlon.

Pattens that were there in Suzlon:

- Debt getting wiped out (debt to equity conversion)

- Equity infusion via Rights Issue

- Losses turning into big profits

- New CEO and CFO joining board

- 1st earnings call: Nov 2022

As a result of some good business decisions and some luck (regulations changing, massive investments in wind energy, a competitor exiting India etc.), the stock went up about 8X, from Rs 7.50 per share to Rs 60 today.

—

Prof. Sanjay Bakshi says that when you lose money or lose out on an opportunity (like this one) think of it as tuition fees. Makes you feel less bad. Missing Suzlon taught me some painful but important lessons like pay attention to numbers and not narratives.

Cheers!

One thought on “Lessons from a lost sheep”